This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

The AI fear feels real—but what if it’s just good PR for control?

The future of blood might not come from people.

Forget AI moonshots—it’s all about EXCEL.

U.S. took billions in tariffs. A ruling could undo all of it.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🤔 AI Panic Is the Point

You’ve heard the stories. AI will take your job. Then it’ll build weapons. Maybe even kill us all. Heavy stuff. It’s everywhere. It’s not just fear. It’s a strategy…

Let’s follow the story behind the story… Dario Amodei, CEO of Anthropic, says AI could wipe out 10–20% of jobs in the next few years. Mostly entry-level white-collar work—tech, law, finance, customer service. But look closer, and these headlines tend to pop up right before fundraising or regulation pushes. Coincidence?

There seems to be a pattern here…

A group called Effective Altruism (EA) is pumping $1.6B into AI safety panic. Their biggest backer? Dustin Moskovitz—Facebook co-founder. His org, Open Philanthropy, funds dozens of so-called “independent” AI watchdogs. But they’re not so independent. Same people. Same goals. Same playbook.

And it all ties back to Anthropic… Luke Muehlhauser, Open Philanthropy's senior program officer for AI governance and policy, serves on Anthropic's board.

Here’s their playbook… Regulate the industry. Then control who gets to build in it. They call it global compute governance. Translation? Control over:

Who gets access to chips

Who can build data centers

Who gets AI licenses

What values get coded into the models

The critics call it what it is: regulatory capture.

Because if you help write the rules… You stay in the game. Everyone else gets locked out.

Another twist… After pushing AI regulation in Washington, key Biden staffers now work at—surprise—Anthropic. They wrote the rules. Now they’re cashing in on them.

Bottom line… The real risk isn’t AI turning evil. It’s power being concentrated in the hands of a few people using fear to take control. What we need:

Open competition

Clear rules

Sunlight on the people writing them

Because when power and code mix behind closed doors… It’s not the machines we should be worried about. It’s the humans running them.

2. 🩸 NEW Breakthrough With Your Blood

You’ve probably never heard of Hiromi Sakai. But if you’ve ever needed a blood transfusion—or know someone who has—her team may be building the future of emergency medicine…

Nara Medical University in Japan started human trials for artificial blood. The breakthrough? This blood works for anyone. No blood type needed. No refrigeration. No matching donors.

How it works…

They take hemoglobin from expired blood. Wrap it in a protective shell. No spoilage, no compatibility issues. Mimicking the real thing, minus the cold storage.

Shelf life? 2 years at room temp. That’s insane if you compare it to real blood which only last less than 1 month, and only if kept cold.

Could save lives during disasters, in war zones, or far-off places. No more guessing blood types. No more waiting for donors.

The tests are still small. A few hundred milliliters per volunteer. But if it’s safe and it works, Japan hopes to roll it out by 2030. And they’re not alone. The U.S., UK, and China are chasing the same goal. Why? Because blood shortages are real. And donor numbers keep dropping.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🤓 Excel, Over Moonshots

You’ve probably never heard of Long Lake. But if you’ve ever paid an HOA fee, you might’ve sent them a check. They don’t build apps. They don’t pitch onstage. They just manage homeowners associations. Steady. Simple. Profitable. And that’s exactly why VC form General Catalyst just gave them $670M…

VCs aren’t just backing shiny AI startups anymore. They’re buying old, low-tech businesses—and adding AI from the inside. Call centers. Accounting firms. HOAs. Boring on the surface. But built-in cash flow. Real customers. Predictable revenue.

What these boring businesses lack? Speed. Efficiency. Automation. That’s where AI fits in.

Seems like the emerging model for VC’s now is…

Buy a business that works

Apply AI to cut costs

Scale without burning money

Less pie in the sky startup. More Excel macros on steroids.

Why this matters?

Venture capital used to chase moonshots. Now they’re playing the middle—between startups and private equity. This means fewer bets on the next unicorn. More bets on solid companies that just need a tune-up.

And instead of trying to sell AI tools into legacy systems… They’re buying the system—and plugging AI right in.

The biggest AI winners might not be the ones shouting “disrupt.” They’re the ones quietly fixing boring stuff—behind the scenes.

Top 3 Charts of the Week

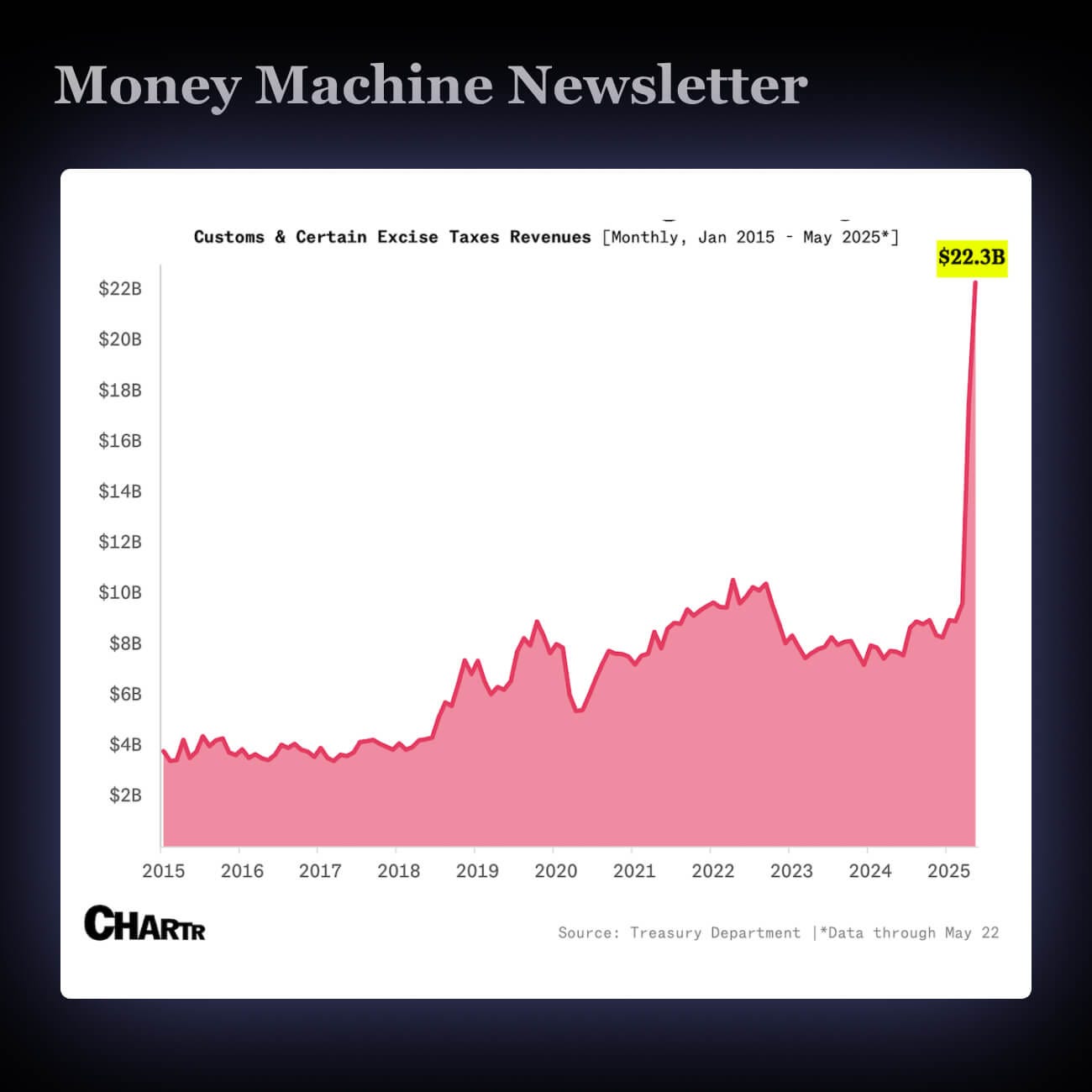

1. 😳 America’s Tariff Collections Hit Record High in May

U.S. government collected a record $22.3B in tariffs this May—but a court ruling says most of those tariffs might be illegal.

If the ruling holds, the government could be forced to give that money back. For now, tariffs are temporarily reinstated.

It’s a big deal for global trade. Billions are at stake. And this court fight could reshape how America taxes imports going forward.

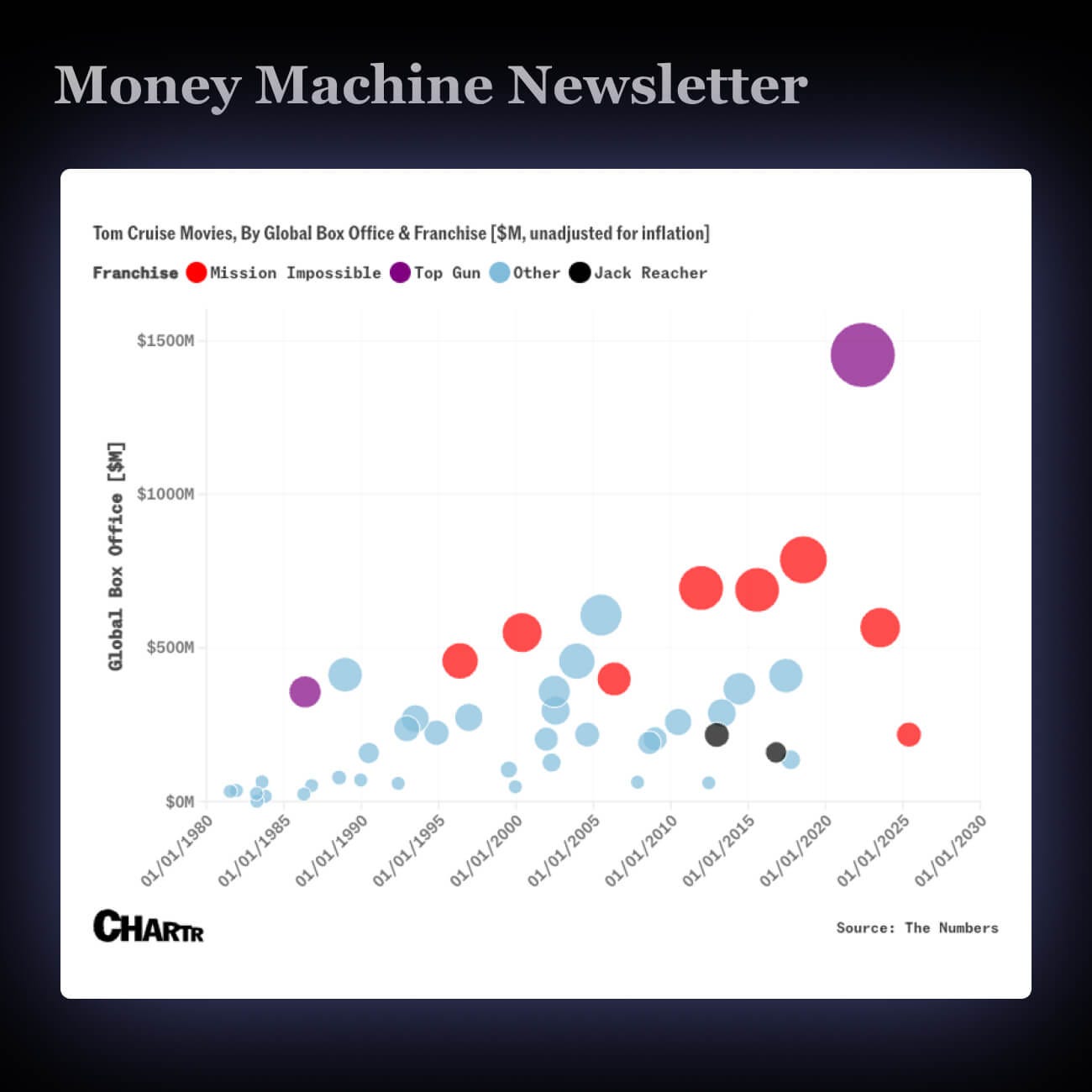

2. 🎟️ The Mission Impossible Franchise Has Been A Box Office Hit Machine For Tom Cruise

Tom Cruise helped fuel a record-breaking Memorial Day weekend at the U.S. box office, with his new Mission: Impossible movie and Disney’s Lilo & Stitch remake raking in $260M combined.

Even at 62, Cruise proves movie stars still matter. His films have grossed $12B worldwide—he’s still a box office machine.

Theaters aren’t dead—yet. Cruise’s draw helps keep the lights on at places like AMC—and maybe keeps popcorn popping too (6M+ pounds sold that weekend).

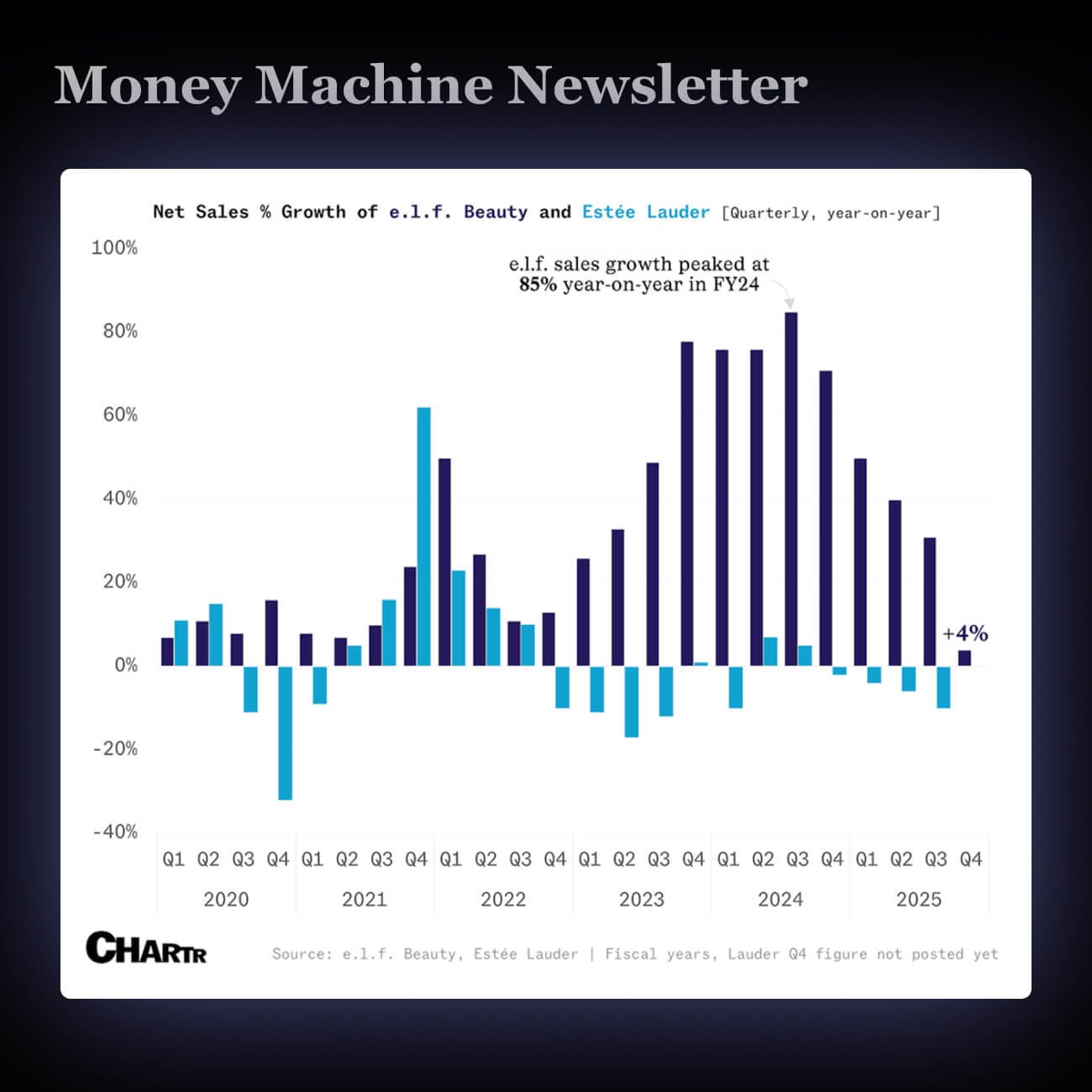

3. 💰 e.I.f. Sales Are Still Brushing Up, But Slowing Down

e.l.f. Beauty is buying Hailey Bieber’s skincare brand rhode for $1B. rhode doubled its customers and made $212M in sales over the past year.

e.l.f.’s sales growth is slowing (up only 4%), so it’s betting on rhode’s popularity—especially with Gen Z—to bring fresh energy and boost future growth.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.