This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

THIS tiny company runs 50,000+ miles of pipelines fueling AI.

An FDA approval that could end Big Pharma’s painkiller monopoly.

What most missed in Google’s $75B bet.

U.S. losing money on THIS for 19 years straight.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🛣️ AI Boom’s Hidden Toll Booth

Everyone’s watching AI, chips, and the cloud. But the real choke point?… ENERGY… And one small Texas company is quietly becoming the backbone of it all… Enterprise Products Partners (EPD)…

While Nvidia sells GPUs, and Microsoft builds data centers, EPD is the “toll booth” collecting fees on every energy transaction that keeps AI running… they control over 50,000 miles of pipelines, moving natural gas, oil, and petrochemicals.

Why we’re paying close attention…

~80% of profits go to investors as big dividends.

EPD profits regardless of which AI company comes out on top.

Texas and Virginia, big AI data hubs, are pushing their power grids to the limit.

Big tech is snapping up energy infrastructure, but they still need EPD to keep the fuel flowing.

EPD is an AI-linked energy play… we’re keeping a close eye on it—along with a few others… become a premium subscriber with Money Machine Newsletter to get our buy/sell setups.

2. 💊 FDA Just Shook Up Painkillers

iPhones improve every year. Self-driving cars exist. AI is changing everything. But painkillers? Stuck in the past for over 20 years… until now… the FDA just approved the first real alternative to opioids… and it could end Big Pharma’s painkiller monopoly… Vertex Pharmaceuticals’ Journavx, a non-opioid painkiller…

How does it work?

Unlike opioids, which dull everything, leave you groggy, nauseous, and addicted, Journavx does one job—blocking a specific pain signal (NaV1.8) without messing with the rest of your body.

Vertex shares jumped ~7% after approval... HUGE potential to disrupt a $100B+ pain market.

Other reasons we’re paying close attention…

Q4 earnings drop Feb, 10th. Market expects $2.78B in sales, $3.99 per share in profit. If the company does better than expected, the stock could JUMP.

Casgevy, their one-time treatment for sickle cell and beta-thalassemia, just launched. Early sales, $2M.

More drugs are in the pipeline, including Alyftrek, a cystic fibrosis treatment.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $90/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

TRY RISK FREE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $90/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. 🤔 What Most Missed in Google’s $75B Bet

AI will make money gutting businesses’ payroll, a.k.a eliminating employees… but the real AI money printer?… Ads… and only two companies are in the perfect position to dominate… Google and Meta (for this piece we’ll focus on Google)…

Google announced a $75B investment in AI and data centers for 2025—a 42% increase over last year.

Why does this matter?

Google’s ad business is a machine. AI makes ads more precise, boosting profits.

AI could supercharge Google’s cloud business, which is already up 30% YoY.

If even a fraction of this $75B improves targeting and cloud efficiency, it’s a major W for them.

$75B investment is a no brainer…

Google needs $27B in extra yearly profit for this investment to make sense… that number comes from Return on Invested Capital (ROIC).

High level breakdown:

A solid ROIC for Google is ~20% → 20% of $75B = $15B profit per year.

They spread $75B investment over 6 years (lifespan for Google’s equipment), that’s $12.5B per year in cost recovery.

Total needed for this to be a win? $27.5B per year in profit ($15B in profit + $12.5B in cost recovery).

Can they hit $27.5B?… we wouldn’t bet against them…

Just last year, Google made $100B in profit.

AI-powered ads could add billions in revenue.

Their cloud computing is growing ~30% YoY. AI could push it even higher.

Bottom line…

Google is making a calculated bet... just like when they built cheaper, smarter infrastructure before… if they nail it, they’ll tighten their grip on AI and cloud.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Ideal Wealth Grower, join 3,000+ subscribers learning how to invest in residential real estate for early retirement. It’s free, on point, and a must-read—delivering market news, deals, and tips in under 5 minutes!

👉 TheDailyDollar, if you’re into finance, investing, or crypto, The Daily Dollar is worth a look. Abhaya Anil shares how he's made millions in crypto, along with real lessons, mistakes, and practical money tips from his 15 years of experience. It’s honest, simple, and actually helpful.

👉 Global Dividend Journey, unlock the secrets to growing your wealth with dividends! Join to to learn smart investing, dividend strategies, and tips for steady passive income.

👉 Cyber H3rmetica, stop being a normie and join 3,000+ readers exploring the dark side of the Digital Age. Cyber Hermetica dives into the crossroads of technology, philosophy, occultism, and cybersecurity—your guide through a world in transition.

👉 Nuclear’s Substack, advanced option trading strategies based on the #1 Amazon bestseller The Nuclear Option.

Top 3 Charts of the Week

1. 📉 Pennies Are Costing More Than They're Worth

DOGE wants to scrap the penny. Making a penny costs more than a penny, 3.69 cents each. The U.S. has lost money on them for 19 years straight.

Canada ditched pennies in 2013. Cash payments rounded to the nearest 5 cents. Credit card transactions still charged the exact amount—no rounding.

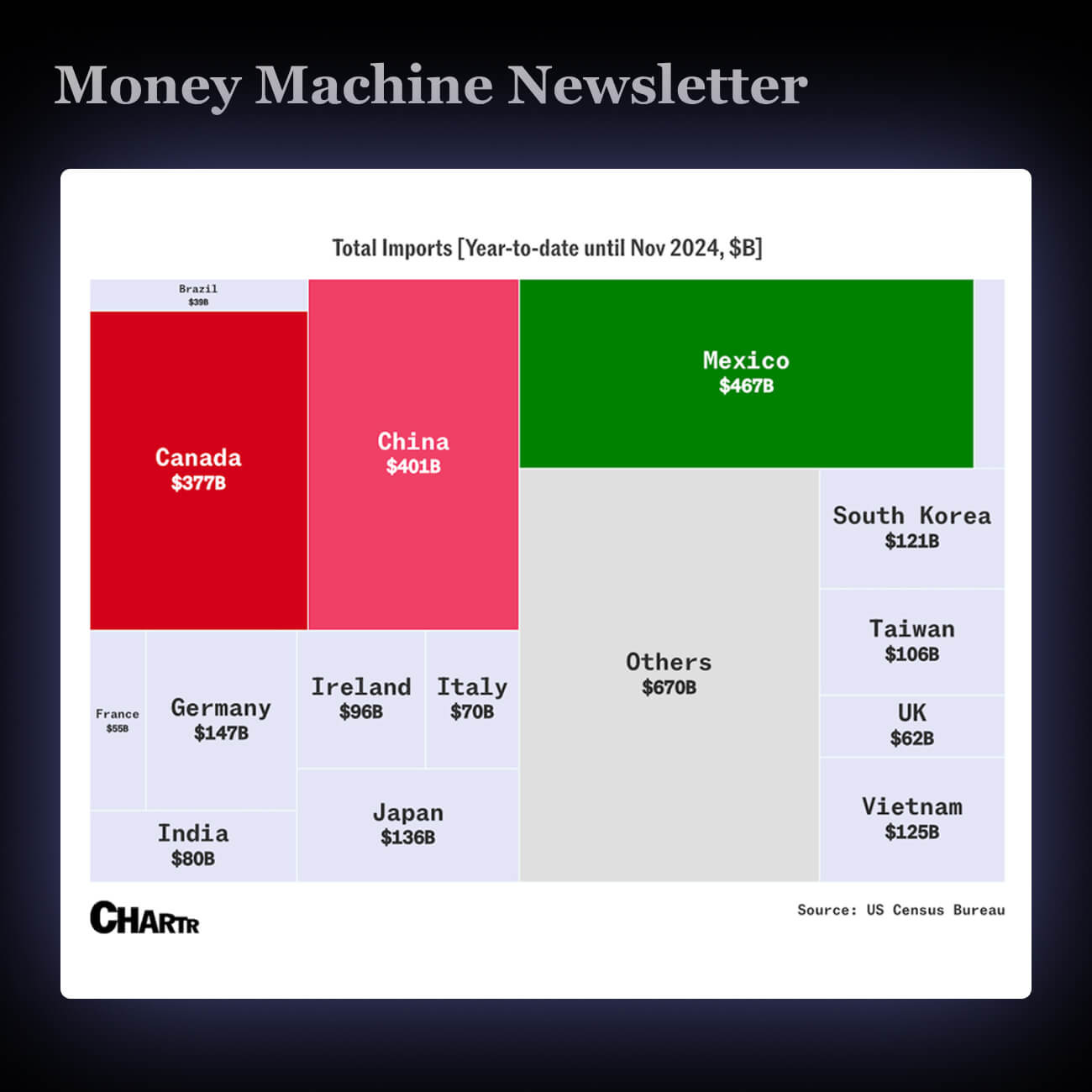

2. 📦 Canada, Mexico & China Supply 42% of U.S. Imports

U.S. is slapping a 25% tariff on imports from Mexico and Canada, plus 10% on goods from China… Mexico and Canada got a one-month delay, but China are still on the hook.

This mean higher costs for companies relying on imports. Goldman Sachs says this could shrink S&P 500 profits by 2-3%. Expect ripple effects like inflation, interest rate changes, and supply chain shifts.

3. 😳 Amazon Prime: Used by 75% of U.S. Adults in 2024

Amazon shipped 9B items in 2024 with same or next-day delivery. Prime members saved $95B on shipping. In the U.S., that’s $500 per person—almost 4x the cost of Prime.

Prime isn’t slowing down. In 2024, 194 million Americans used it—that’s over 75% of U.S. adults. Despite talk of a plateau, fast delivery and perks make it a must-have.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.

Other pipeline companies such Energy Transfer Partners and All American Pipeline should benefit ss well. (ET)(PAA)