Hey,

Today we’re featuring a favorite newsletter that we follow, InvestOrama…

Most investment advice is noise. Marketing disguised as insight. InvestOrama cuts through that.

George Aliferis—ex-investment banker turned truth-seeker—breaks down finance with clarity and skepticism.

If you invest, advise, or just want to think smarter about money, this is worth your inbox. Make your you subscribe below!

I’ll let InvestOrama take it from here…

I’ve been spending a lot of time trying to understand DeepSeek and its impact on markets following the selloff it triggered at the end of January. I’m not doing this out of intellectual curiosity. I’m thinking of the impact on my equity portfolio.

Could this be the end of the bull run we’ve experienced since 2022?

That’s a legitimate question because cleverer people than me are asking it too:

like Philoinvestor

Others even go for the affirmation:

I’m trying to find an answer—at least a partial one—through the study of narratives, inspired by Shiller’s Narrative Economics course and writings.

There’s so much content about DeepSeek that I am going to restrict myself to just 3 sources that I highly recommend in addition to the ones I mentioned above (i.e. this is subjective):

A video from the Computerphile channel

this post from Aswath Damodaran

this one from Net Interest

The AI narrative and the bull market

Remember how, at the end of 2021, we suffered a hangover from the “Zero Interest Rate Period” party or ZIRP, with Big Tech (known then as FAANG), correcting sharply?

Many thought this would last.

But markets found the cure that we’re still missing for real-life hangovers. They bottomed out in the last quarter of 2022 and have been on an impressive run since. The Magnificent 7 replaced the FAANGs.

The cure? AI

From Aswath Damoradan:

The AI story broke out to the public on November 30, 2022, when OpenAI launched ChatGPT, and it made its presence felt in homes, schools and businesses almost instantaneously. It is that wide presence in our daily lives that laid the foundations for the AI story, where evangelists sold us on the notion that AI solutions would make our lives easier and take away the portions of our work that we found most burdensome, and that the businesses that provided these solutions would be worth trillions of dollars.

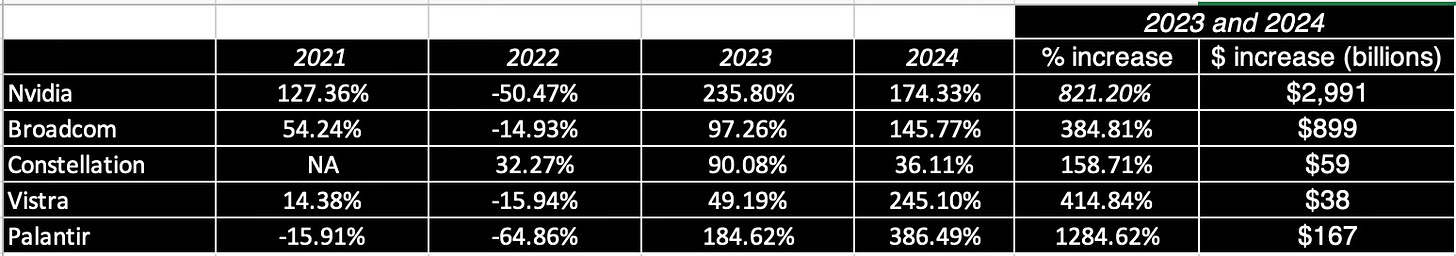

He’s calculated the returns from Capex receivers that benefit from investments in the AI space:

And from Big Tech, who benefit from it in multiple ways but primarily as they have the capital, data, and computing power to surf the AI wave.

Two protagonists are missing from these tables:

Nvidia whose valuation is roughly 10x since November 2022 - I say roughly because it’s moving fast!

OpenAI in the private markets, it reached a valuation of $150bn in the last funding rounds and there were talks of $300bn in the next round, but that was before DeepSeek

Applying Narrative Economics to AI

The epidemic model

Shiller applies an epidemic model to narratives, the SIR model, based on populations characterized by 3 parameters that add up to 100%

Susceptible

Infected

Recovered

I’m skipping all the details, but it creates cool Normal distribution curves based on the infection rate. A high Infection rate will increase the New Cases curve (yellow), and move the rest accordingly.

The “Infection” rate for AI based on its usage is extremely high. I see it around me at the office, but here is my main piece of evidence:

My dad, an 80+ retired engineer who refuses to use technology he doesn’t fully understand. He only started using emails when I disappeared for months in the Argentine pampa (long story, and a long time ago) and wanted to check if I was alive. He still hasn’t got into the habit of Googling stuff.

But he uses chatGPT daily.

What type of narrative are we dealing with?

I will now borrow the title of the chapters from Shiller’s course to identify the type of narrative we’re dealing with.

Contagion of economic narratives builds on opportunities for repetition

If something brings up repetitions of the narrative that helps lower the recovery rate, the forgetting rate. Contagion of narratives depends on opportunities for repetition.

Narrative constellations have more impact than any one narrative

Stories that are contagious because of other stories. […] They're connected in the minds of the tellers, as related to things that other people are genuinely interested in now. But somehow our brain groups certain stories together. And you recognize some story as a member of a constellation.

And your success as a storyteller, as a good conversationalist, depends on your ability to sense what's interesting. And successful politicians are specialists in doing this. Entertainment people are specialists in doing this. They have an intuitive grasp of the constellations of narrative, how they fit together. And they try to add to them with exciting new versions of the basic narrative that is underlying.

The AI story did not suddenly appear with ChatGPT, but for most of us it was an abstract concept until Generative AI started impacting our daily lives (repetition).

And it’s a constellation because of its connection with other stories. Shiller talks about politicians and entertainers; he missed the CEOs on the list. I will use a master storyteller, Sam Altman to dig a bit more in the constellation.

Trivia: Amusingly, if you follow the course, you will remark there are perennial narratives that keep coming back. AI / Automation is one of them. In fact, it was one of the narratives driving the price of assets down a century ago, following the 1929 crash

AI as a narrative Constellation

Sometimes a constellation fits into a sentence

You’ve heard this one before; here is a shortened transcript:

I don’t care if we burn $50Bn a year. We’re making AGI. It’s totally worth it.

There’s a lot to unpack and it’s worth listening to. There can be multiple possible interpretations (and even more questions like: What is AGI? Are we actually getting there? Etc.)

At first it may sound aspirational: AI is a benefit to society, a gift to the world (Maybe this was recorded when OpenAi was still a non-profit).

I will use a more corporate lens:

There’s a discounted cash flow angle (It’s worth it): We can justify huge capital expenditures because it’s a worthwile investment: the product we are developing will be monetized and justify the expenditure

A competitive angle: we can burn $50bn. We are (one of) the only ones who can attract the capital required to create the product, therefore we have a sort of monopoly.

This must have got all the Capex receivers very excited. Those listed by Asmath that provide chips (Nvidia), data centers, energy…

It’s a bit like declaring to a builder: “I don’t care how much this refurbishment will cost; I want my house to be the best-looking on the block”. (My advice: don’t do it)

Who’s got the biggest AI spend?

I will copy the intro from the Net Interest post:

Earlier this month, President Trump unveiled the Stargate project, a joint venture between Softbank, Oracle and OpenAI to invest $500 billion over four years to support the deployment of AI infrastructure in the US. Starting with an initial site in Abilene, Texas, Stargate plans to build up to ten AI data center facilities of 500,000 square feet each. (“They don’t actually have the money,” posted Elon Musk. “Want to come visit the first site already under way?” replied Sam Altman.)

The same week, Meta announced plans to spend as much as $65 billion this year on AI infrastructure, including a new 2 gigawatt data center “that is so big that it will cover a significant part of Manhattan if it were placed there,” according to Mark Zuckerberg.

Last year, Larry Ellison of Oracle revealed he’s building a data center in Salt Lake City so big “you could park eight 747s, nose to tail, in that one data center.”

And Microsoft reiterated that it is on track to invest approximately $80 billion in 2025 building out AI-enabled data centers.

The Emphasize is mine : Note how the storytelling uses visual metaphors and… Stargate!

I’d also like to add that Microsoft actually had a much more gangster response to Elon Musk who was doubting the commitment, “We’re good for $80bn”. Nice!

That’s what Big Boys say, but even plain multi-millionaire CEOs do the same

More Than 40% of S&P 500 Companies Cited “AI” on Earnings Calls for Q2

If you don’t have an AI strategy, your share price will suffer. If you say you will spend x billions on Nvidia, your stock will get a bump (that was the case until last month).

What DeepSeek changed in the narrative

First, we may see the DeepSeek announcement as a carefully crafted narrative.

Many people doubt that they’ve only spent only $6m (including Aswath Damodaran quoted above), OpenAI said they have inappropriately used its data, the US commerce nominee called DeepSeek and technology thief…

Maybe.

But that’s where I turned to Computerphile. And I will jump to their conclusion: DeepSeek is a game changer for AI.

And that’s why the attempts at a squashing the DeepSeek narrative has zero chance of prevailing.

They do a great job at explaining the details, and it’s not my purpose here, but I will just summarise it in 3 quotes:

It’s open source so we can understand and replicate what they’ve done

They’ve made huge savings in terms of how they use the data ( I train a different network to solve a different problem, and I just ask the right one, as opposed to hoping that one model can do it)

They've made a lot of mathematical savings in terms of the number of mathematical computations you have to do to go forward through a network,

And they conclude:

Those companies that have loads of GPU still have an advantage for a while, but it's a leveler over time. People can do stuff with more limited hardware.

If you look at this in parallel with the quote from Sam Altman from above, it’s clear that some parts of the narrative are particularly affected.

The idea that OpenAI, and the handful of few players that can spend ‘$50bn per year' have a de facto monopoly.

The idea that AI is one solid block (AGI?) rather than a whole spectrum

The idea that it’s an arm race that wil require Stargate-sized investments

Basically the first part of the sentence: I don’t care if we burn $50bn.

If you look closely at the price action following the DeepSeek news (at the close on 31 January 2025, before the tarrifs were announced):

Google (Alphabet) and Meta have reached new all-time highs.

Microsoft is lower (it has a considerable stake in OpenAI)

Nvidia, and all the Capex receivers are considerably down.

It points to the fact that the second part of the sentence I used to encompass the whole “AI narrative”, is still intact:

We’re making AGI. It’s totally worth it.

In other words, developing AI products has become cheaper, but we don’t question Sam Altman’s assessment that “AGI” - or AI products - is a big deal.

We could imagine that the narrative would break if the narrative switched hypothetically to something like:

AI doesn’t have such a dramatic impact after all

AI is commoditized , hard to monetize

In other words, the narrative that drove the market since the end of 2022 has evolved but does not appear broken. But… that only works if we take it in isolation. This narrative investigation is limited in scope, but I do believe it has some usefulness in asset allocation.

Trade tariffs were announced yesterday, and I have no idea how this narrative can unfold or even if narratology can be applied to it.

And that’s where we should have a big disclaimer, but I’m not going to say “Do Your Own Research” because my previous post said “Do Your Own Thinking”.

Thanks for reading InvestOrama! Subscribe for free to receive new posts and support my work.

Here’s the Pixar Pitch version:

Once upon a time, there was a new tech called AI. Every day people were using it and investing a lot to develop it, and everybody was excited . Until one day a company called DeepSeek made it look a lot more accessible to develop. Because of that, the stars of AI Capex dropped. Because of that, the AI narrative became more nuanced.

Until finally… [THE ENDING IS STILL IN PRODUCTION; here is just one possibility for the final draft] there was a trade war, and that AI narrative was eclipsed by a more powerful one.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.

Nice one, MMN! Thanks for sharing