🧬 AgTech Desert Crops

Plus: Don’t Bet Against Argentina, Perplexity’s $3B Valuation in Trouble?, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Ohalo's technology allows plants to pass 100% of their genes to offspring.

Stanley Druckenmiller invests in Argentina after Javier Milei's speech.

Google launches new AI search experience.

SEC approves spot Ether ETFs–enabling mainstream investment.

Groq eyes $3B valuation.

And more…Let’s get to it!

Follow us on Instagram | Advertise to our 7K+ subscribers

Top 5 Insights of the Week

1. 🧬 AgTech Desert Crops

Ohalo's technology allows plants to pass 100% of their genes to offspring.

What does this mean?

Helps crops grow in previously unsuitable regions, like deserts.

Crop yields increase by 50-100%.

Reduces food prices.

$100B potato market represents the third largest source of calories on Earth.

Agricultural technology market valued at ~$23B in 2023, and projected to reach ~$62B by 2031.

2. 🇦🇷 Don’t Bet Against Argentina

Stanley Druckenmiller invests in Argentina after seeing Javier Milei's Davos speech.

Purchased the 5 most liquid American Depositary Receipts (ADRs) for Argentinian companies.

Why is Druckenmiller bullish in Argentina?

Milei cut Social Security by 35%, shifted from a 4-5% deficit to a 3% surplus.

Milei's policies reduced interest rates and improved investment conditions.

Milei is the only current global leader implementing free-market principles effectively.

Druckenmiller follows Soros' "invest then investigate" strategy—betting on Milei's economic reforms to stabilize Argentina.

3. 👀 Perplexity’s $3B Valuation in Trouble?

Google's "AI Overviews" search offers guides with citations and targeted ads— very similar to Perplexity (valued at ~$3B).

Could lead to major lawsuits for two reasons:

Uses creator’s content without proper permission.

Reduces traffic to creator’s sites, affecting their ad revenue.

Potential for boost in revenue by integrating targeted ads in AI-generated answers—without ever leaving the page.

Marketplaces for licensing AI usage rights already emerging:

4. 🟢 SEC Greenlights Ether ETFs

SEC approves spot Ether ETFs–enabling mainstream investment in the world's second-largest cryptocurrency.

Expected to unlock billions in institutional investment.

Ether price surged 64% in 2024, with a 22% rise in the past few days.

Companies still need to get S-1 filings approved before trading.

5. 😯 Groq Eyes $3B Valuation

Groq is negotiating to raise $300M–potentially valuing the company over $3B.

Their LPU chips, designed specifically for AI inference, are considered the fastest and most cost-effective for running open-source models like Llama 3.

Previously raised ~$367M from firms like Tiger and D1.

Groq has deployed 4,500 chips and plans to reach 1.5M by next year.

*from our sponsors

Maritime Analytica

Your gateway to the world of container shipping🚢. Join over +11K subscribers in exploring the latest maritime news 📰, sustainability practices 🌱, cutting-edge tech 🌐, financial trends💸, captivating games 🎮, and inspiring maritime arts 🎨. Stay informed, stay ahead. ⚓ Join today for free.

Learning With Data

Unlock expert insights from a hands-on CTO to build happy, high-performing tech teams. Get practical advice every week—start for free today!

Top 3 Charts of the Week

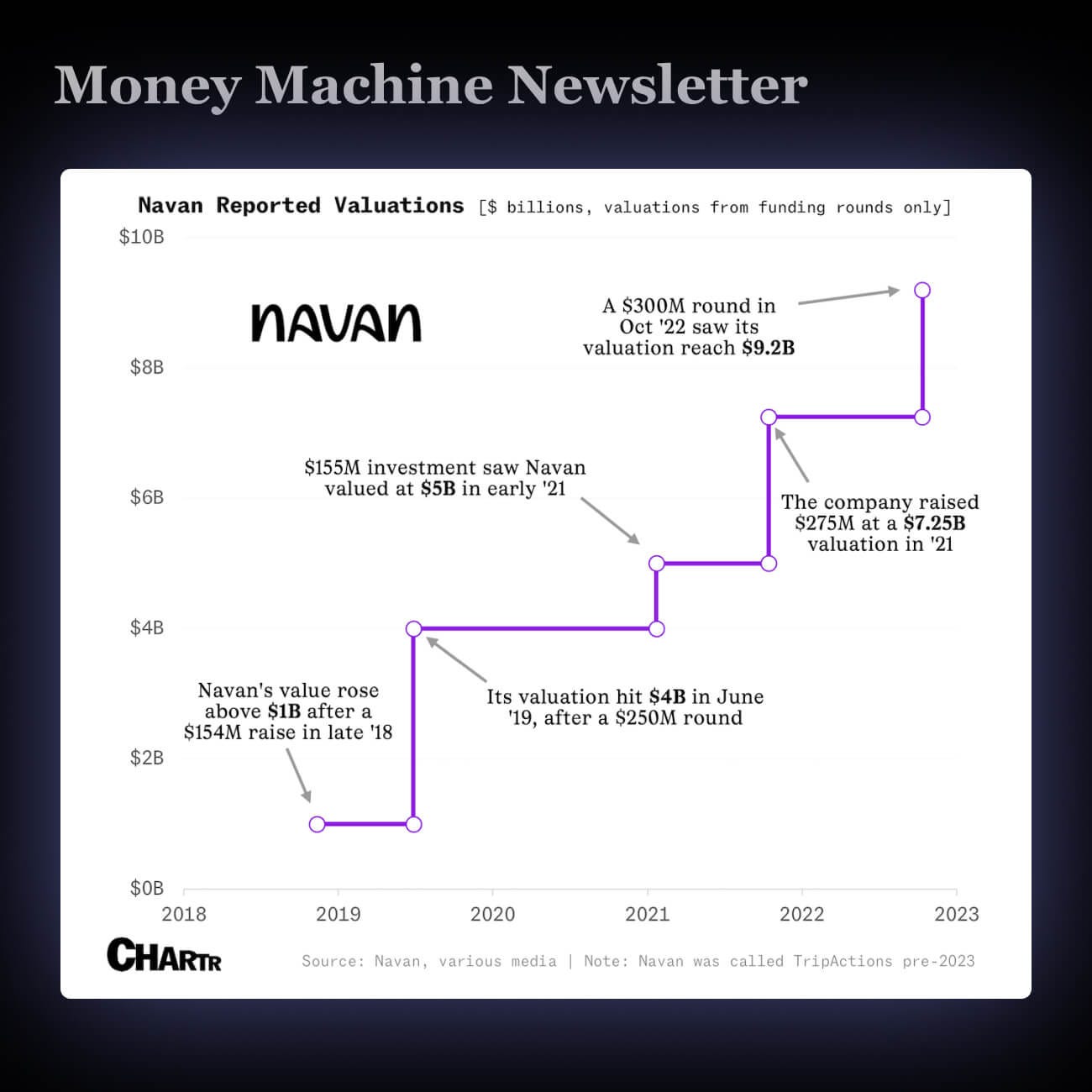

1. 📈 Navan's Valuation Continues to Soar

$9B travel tech firm, Navan, aiming for IPO–forecasts a profitable year.

Major clients include Heineken, Shopify, Zoom, and Pinterest.

Founded as TripActions in 2015, rebranded in 2023; valued over $1B since 2018.

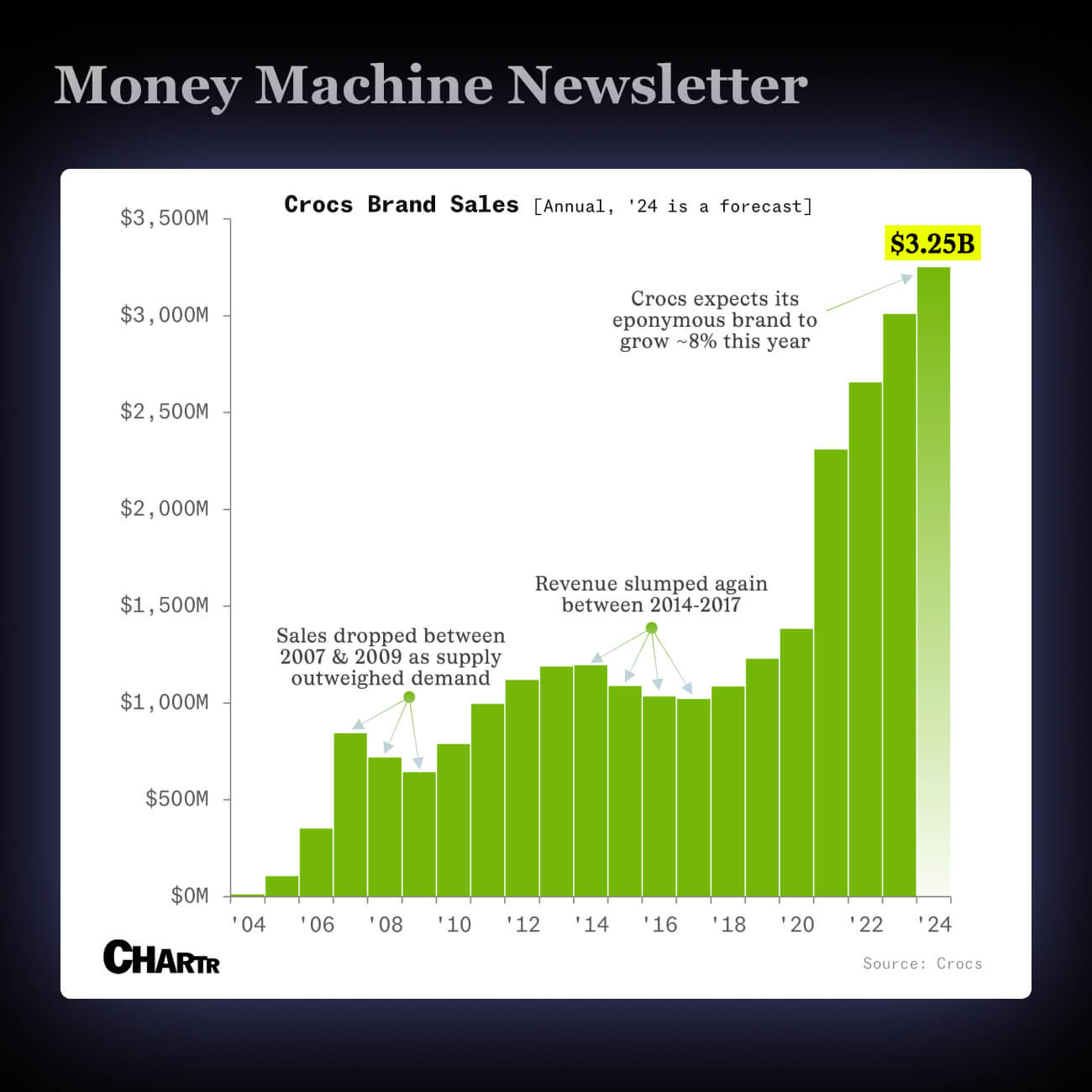

2. 🐊 Crocs a $3 Billion Annual Business

Crocs' Q1 2024 sales increased ~15%, reaching $740M; 2024 projections at $3.2B.

Faced significant sales declines and a $185M loss in 2008.

Revival came through strategic collaborations and a strategy shift under CEO Andrew Rees since 2017.

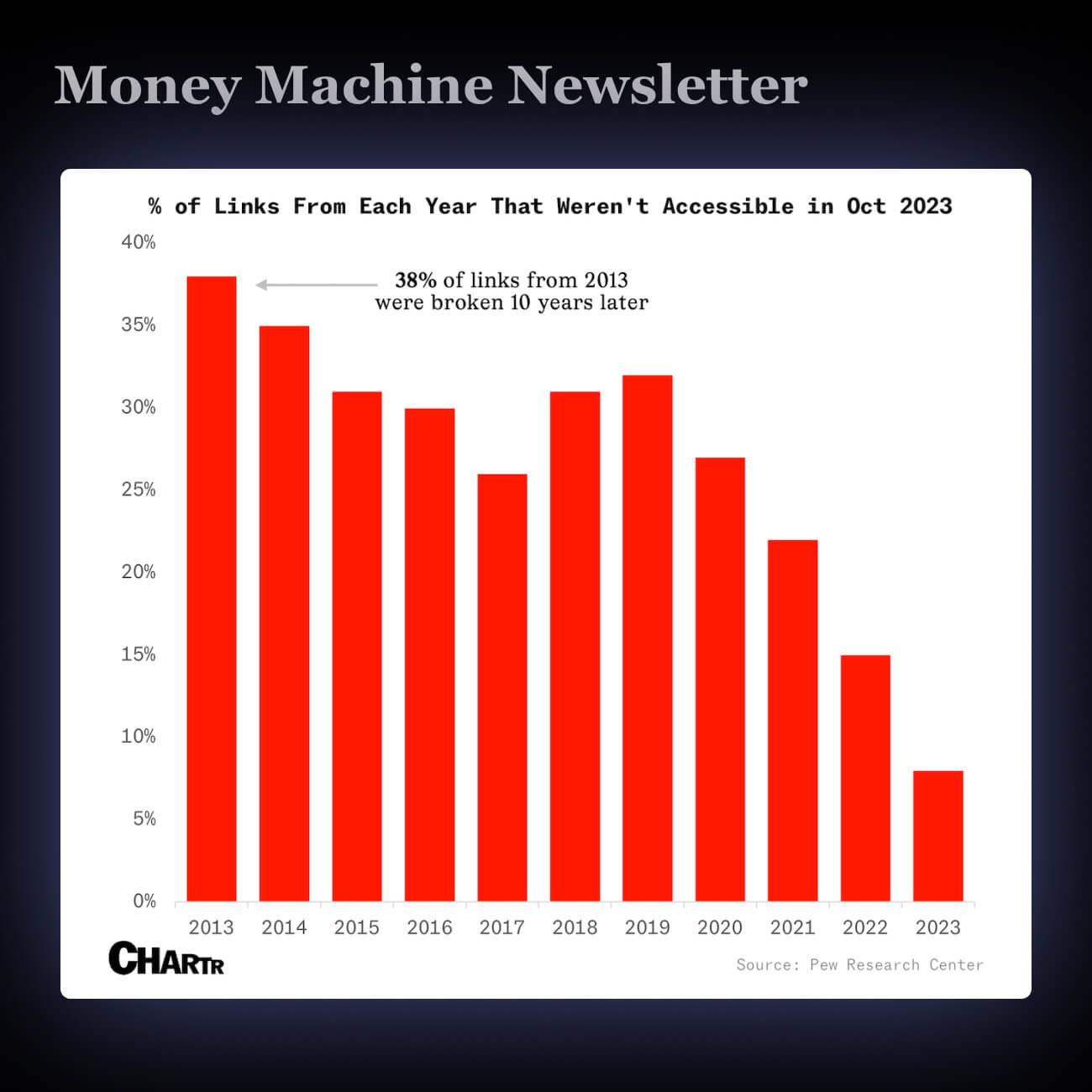

3. 💀 The Internet's Digital Graveyard

Dead links are widespread—38% of 2013 links broken by 2023.

21% of government and 23% of news site pages contain dead links.

"Dead internet theory" suggests bots creating most online content.

Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber 🚨

TOP 5 STOCK IDEAS, picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS throughout the week as we spot them.

Access to OUR COMMUNITY of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY of which ideas performed best.

NO GUESSWORK. You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS, discover opportunities and risks not highlighted elsewhere.

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.