💊 A Rare Human Trait Could Soon Be a Drug

Plus: How Rewording THIS Question Made Someone $85M, Large Companies Crumbling Under a New Force, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Thriving on 4-6 hours of sleep thanks to THIS rare mutation.

An absolute legend made ~$85M just by rewording a question.

Large companies are faced with a stark choice… evolve or vanish.

Orange juice is in crises mode right now.

And more. Let’s get to it!

Follow us on Instagram | Advertise to our 5K+ subscribers

Top Insights of the Week

1. 💊 A Rare Human Trait Could Soon Be a Drug

Sleep is part of a $1.8T goldmine… All sorts of products and medications out there to help you get more/enhance your sleep. Here’s the thing… what if all along the real answer was just… get less sleep?

Scientists found rare genetic mutations behind Short Sleeper Syndrome (SSS), allowing some people to thrive on just 4–6 hours of sleep.

The genes behind this remarkable discovery…

DEC2: The first short sleep gene discovered in 2009.

ADRB1: A mutation found in 2019 that promotes wakefulness.

NPSR1: Another gene linked to natural short sleep.

They’re all extremely rare, e.g. NPSR1 gene is found in fewer than 1 in 4M people.

Mice engineered with the sleep mutation slept almost an hour less but stayed just as healthy and alert... the University behind this breakthrough... UCSF. And 3 major pharma giants are taking notice...

UCSF and Pfizer have a history of teaming up to fast-track new therapies. Don’t be surprised if they jump all over this.

Sanofi could use SSS research to enhance their product lineup.

Eisai, makers of insomnia meds, could leverage this research for new treatments.

There's a huge opportunity here for whoever runs with this to create a category of one. Not just fix sleep issues… instead… completely sidestep direct competition with a new solution, a “safe sleep-reduction” drug. Sparking a billion-dollar market from nothing.

2.❓How Rewording THIS Question Made Someone $85M

"Who are you voting for?" vs. "Who do you think your neighbor will vote for?" Just asking the latter made someone ~$85M. Who is this someone? Théo, the French whale.

Théo bet ~$70M across 11 Polymarket accounts on Trump’s victory and made ~$85M in profit. Absolute LEGEND.

How did he pull this off?

He paid a polling company to ask swing-state voters the “neighbor effect” question…“Who do you think your neighbor will vote for?”

The results he got back “were mind blowing to the favor of Trump!”

The "neighbor effect" works like this... People may lie about their own choices, but if you ask who their neighbor will vote for, the truth slips out. It's bias-free and reveals their real thoughts.

Mainstream media had a different narrative… “the race is a tossup”… Théo said, PUMP THE BRAKES. He saw the mispriced opportunity and went all in.

But wait… how the hell did they find our boy Théo? One word… Chainalysis… it’s a $10B crypto forensics firm used by governments to trace down crypto wallets.

Over $3B was bet on Polymarket during the election.

As predictive markets and digital currencies rise, crypto forensics will boom...

Coinbase Tracer, used by the ICE and DHS for blockchain forensics.

Elliptic, a crypto tracking firm.

Arkham, focuses on deanonymizing blockchain transactions.

Palantir's tools have helped crack crypto cases for governments.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

Get $13,890.80 worth of value for just $9/month to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. 🫡 Large Companies Crumbling Under a New Force

“1 person + 10,000 GPUs could make a billion-dollar company”...Sam Altman. He’s not far off. It all comes down to solopreneurs leveraging the HELL out of AI…

Ivan Kutskir literally recreated a multi-billion dollar product 1:1… Photoshop. His version, Photopea, 13M visitors/month, +$1M revenue/year. 0 employees.

Clement Pikilipita created PIKIMOV, free web-based alternative to After Effects, 60k+ visitors/month. 0 employees.

Pieter Levels, makes $2.7M/year, 0 employees, building multiple online platforms.

Tony Dinh, $30K/month, 0 employees, with TypingMind, an enhanced ChatGPT interface.

Those numbers might seem insignificant, but cue the old saying… "death by a thousand paper cuts…" As AI advances, expect more solopreneurs and insanely lean small businesses to come out of the woodwork. Plus, this isn’t new—time and time again, we’ve seen lean small businesses achieve unthinkable results…

WhatsApp, 55 employees, acquired for $19B.

Instagram, 13 employees, acquired for $1B.

Inflection AI, develops personal AI chatbots, $1.5B raised, 33 employees.

Reddit was run by 3 engineers, getting ~1B page views per month.

Large bloated businesses see the writing on the wall…

Google lays off hundreds as ad division switches to AI-powered sales.

Meta used AI to beat Apple’s privacy changes and cut operations costs.

IBM plans to replace 30% of back-office roles with AI.

23andMe cuts 40% of staff in restructuring

Chegg, cuts 21% of staff, as it struggles to compete with AI products.

The list goes on… In 2022, 244K tech workers were laid off. In 2023, it jumped to 430K. So far in 2024, it’s 260K.

The AI tools solopreneurs use today are mind-boggling…

v0 can take a screenshot and clone any website from just a url.

Windsurf lets you build an app with 1 prompt.

Pictory converts scripts or blog posts into videos quickly.

ElevenLabs, lets you create realistic high-quality voice replicas.

YouTube will now auto dub videos.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 ChartScope, explore macroeconomics, crypto, global markets visually. Engage with data-driven insights.

👉 Weekly’s Commodity Insight, get expert insights and weekly market updates on commodities delivered in a clear, friendly format. Covering top commodity market movers, key trends, and helping you stay informed about your earth precious materials.

👉 Crypto Highlights, all the latest Crypto Market news in less than 2 minutes!! You will know everything you need to know saving hours of researching on your own.

👉 CryptoTalk Newsletter, crypto, finance, and investments. Everything you need to know in a daily and free newsletter to make better financial decisions in the future!

👉 Shebatrades, a concise daily market update covering Sheba's thoughts on the major market news and drivers of the day, followed by a discussion of portfolio action and new stock setups.

Top 3 Charts of the Week

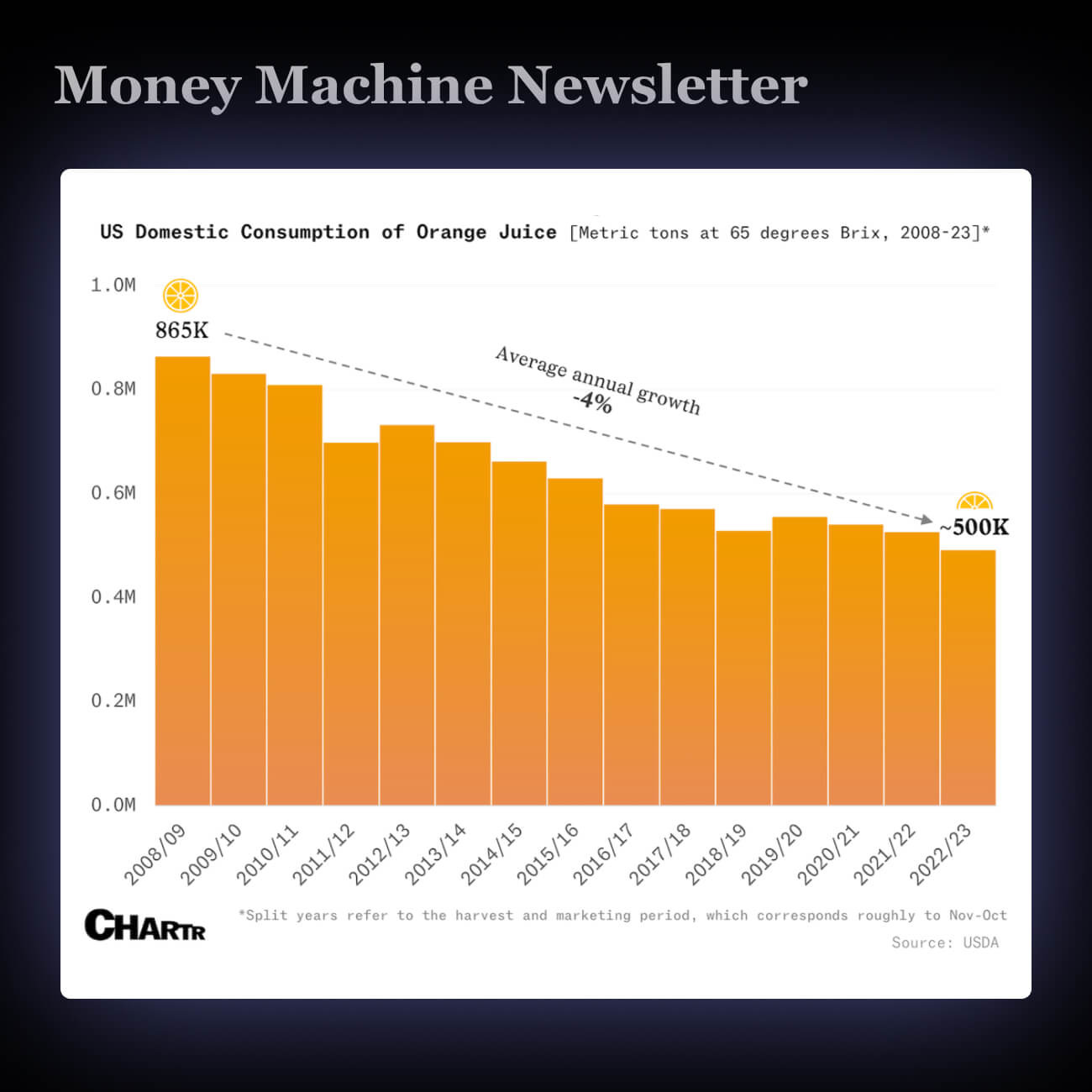

1. 🍊 Americans Are Saying Goodbye to OJ

Tropicana cut its OJ bottles from 52 to 46 ounces. Prices are 5x higher than 2020, and sales dropped 19% last year.

Rising costs, health concerns, and lifestyle changes are turning people away from OJ.

A 12-ounce glass of OJ contains 9 teaspoons of sugar, about the same as a can of Coke.

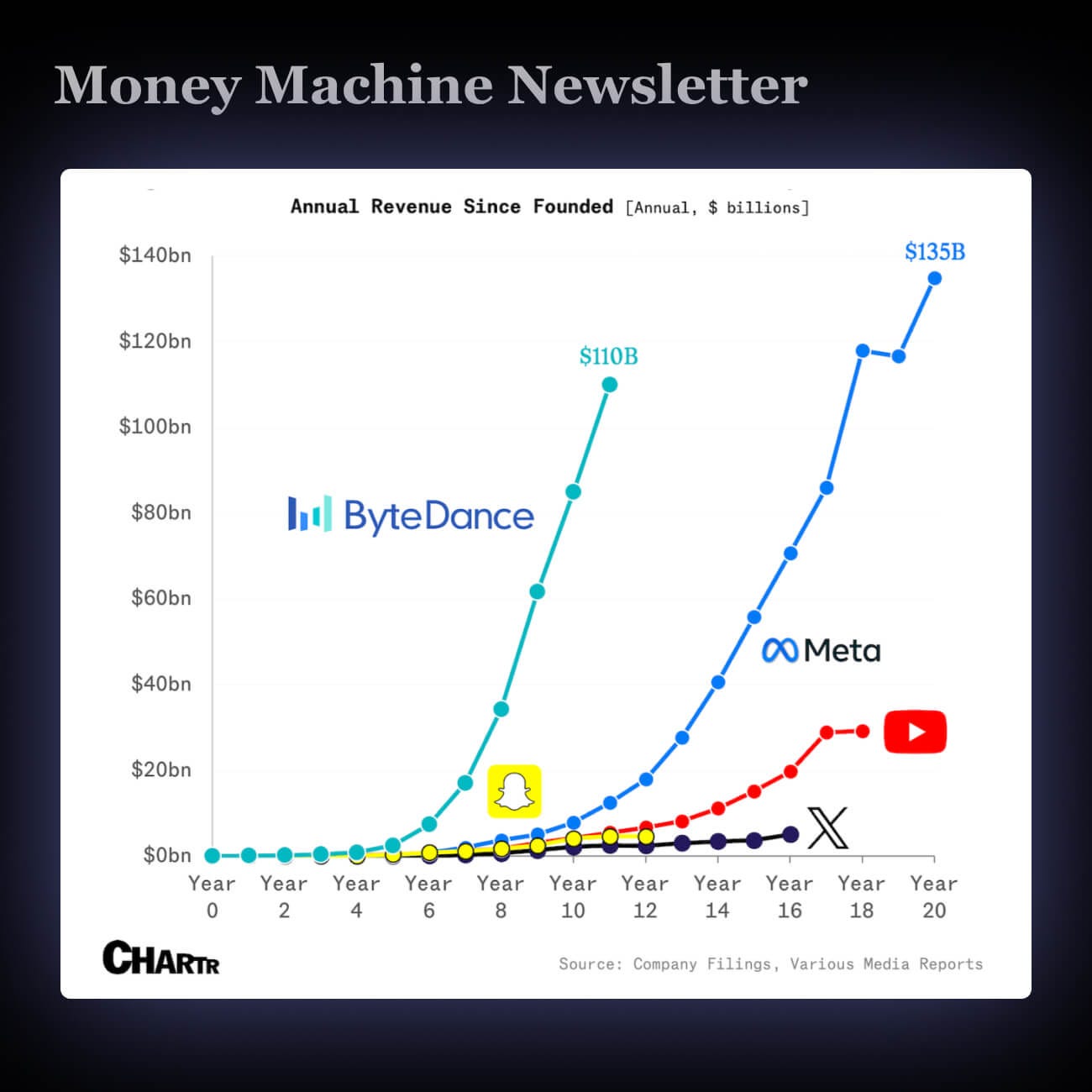

2. 📈 ByteDance’s Explosive Growth

ByteDance is worth $300B after a buyback, with revenue on track to hit $150B in 2024. No IPO plans yet.

It’s growing fast but undervalued compared to Meta. A U.S. TikTok ban adds uncertainty.

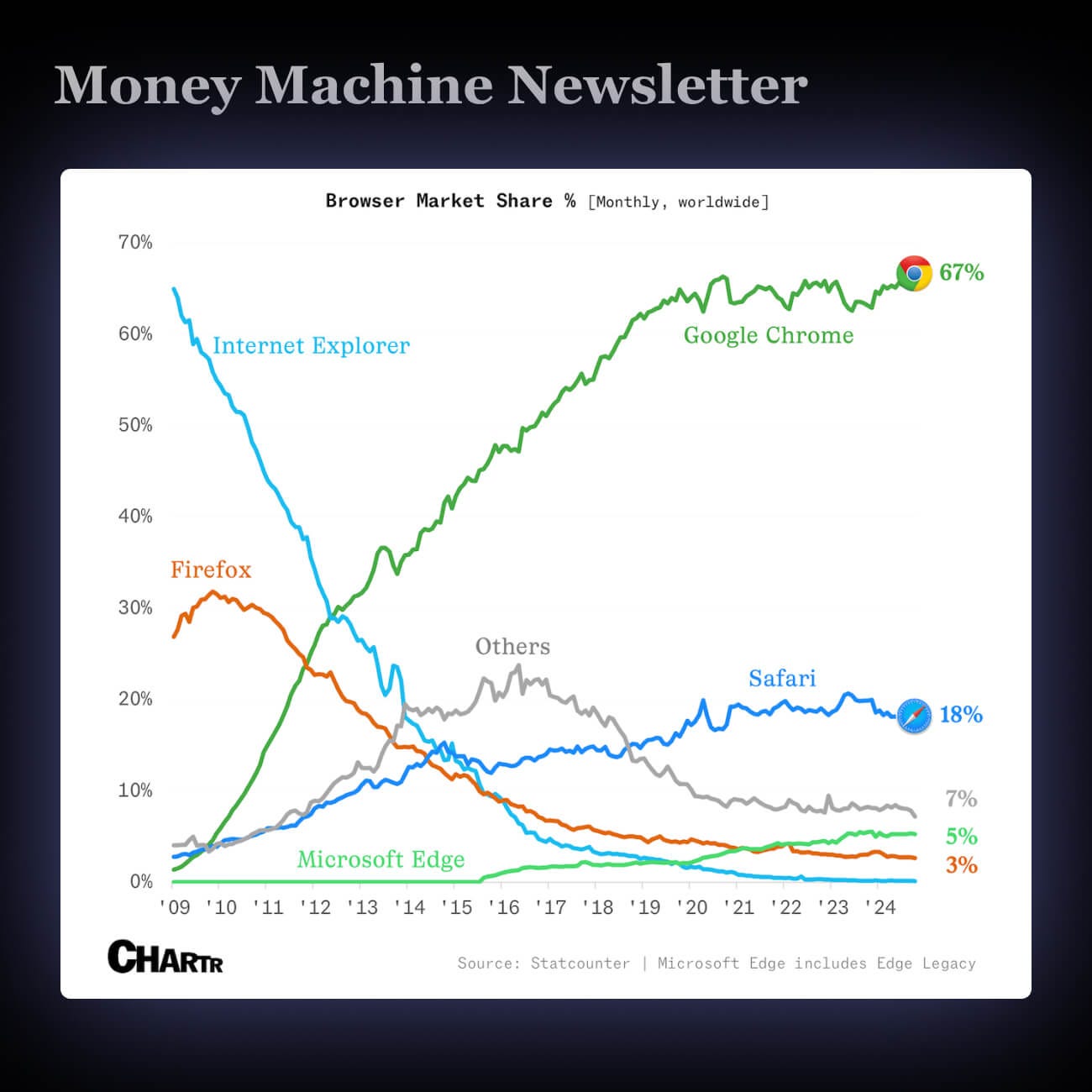

3. 🌎 Google Dominates the Browser Market

The DOJ wants Google to sell Chrome and limit its control over search and data.

Google’s dominance in search (93%) and browser (67%) is under serious threat.

Google pays Apple ~$20B/year to be Safari’s default search engine.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.