🤔 11M Users Left Amazon, Where the Hell Did They Go?

Plus: World vs. China’s Largest Innovation Incubator, SEC Has Had Plenty of L’s In Crypto—But Not This One, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

In a span of 6 months Amazon lost 11M users to Shein and Temu.

“We learned about ChatGPT on Twitter”—Helen Toner (ex-OpenAI board member).

Here’s the one major W for the SEC, handed by Biden on a silver platter.

What happens when US+4 other countries put export controls on accessing cutting-edge chips and equipment?

Never bet against Elon—xAI raises $6B at a $24B valuation from Valor.

And more…Let’s get to it!

Follow us on Instagram | Advertise to our 7K+ subscribers

Top 5 Insights of the Week

1. 🤔 11M Users Left Amazon, Where the Hell Did They Go?

In a span of 6 months Amazon lost 11M users to Shein and Temu. U.S. monthly active users: Temu 47M, Shein 29M, Amazon 66M.

How have Shein and Temu quickly become major competitors?

Aggressive marketing: Temu spent $2B on Instagram and Facebook Ads in 2023.

Deep discounts: Nintendo Switch on Temu for just $15

Q1 2024: Temu 130% revenue surge. Shein earned $45B in 2023.

Pressuring Amazon to lower fees and shift its focus from traditional competitors.

2. 😯 OpenAI Board Has No Power?

“We learned about ChatGPT on Twitter”—Helen Toner (ex-OpenAI board member).

Claims Sam Altman repeatedly lied and was untrustworthy.

“On multiple cases, he gave us inaccurate information on the small number of safety processes the company had in place.”

Claims Altman did not disclose his ownership of OpenAI Startup Fund.

But, there’s a new board in town—will anything change? Maybe at the margins. Sam Altman rejoining the board solidifies his control over OpenAI's direction.

3. 🤡 SEC Has Had Plenty of L’s In Crypto—But Not This One

SEC's L’s in the crypto world:

SEC denied Grayscale's Bitcoin Trust spot ETF application. Court ruled against the SEC—calling their reasoning "arbitrary and capricious."

Ripple challenged the SEC's classification of XRP as a security. Court ruled in favor of Ripple, questioning the SEC's authority.

SEC froze DEBT Box’s assets based on false evidence, was sanctioned by a judge, and ordered to pay $1.8 million in legal fees.

SEC Twitter hack falsely announced Bitcoin ETF approvals, causing market volatility. Turns out they didn’t have 2FA security enabled 🤡.

Here’s the one major W for the SEC, handed by Biden on a silver platter…

Biden vetoed a bill to overturn SEC's SAB 121, maintaining restrictive crypto custody regulations.

It’s surprising since the bill had overwhelming bipartisan support—passing the House 228-182 and Senate 60-38.

Biden's stance could have just lost him the crypto vote for 2024.

4. 🤖 World vs. China’s Largest Innovation Incubator

What happens when US+4 other countries put export controls on accessing cutting-edge chips and equipment? If you’re China, you launch a $48B semiconductor investment fund.

Led by China’s Ministry of Finance. Aims for chip self-sufficiency. Countering $81B US and EU investments.

Chinese chip stocks surged after the fund's announcement.

Investment aligns with Made in China 2025 initiative.

5. 🫡 Never Bet Against Elon

xAI raises $6B at a $24B valuation from Valor, a16z, Sequoia, Fidelity, and others.

Plans a "gigafactory of compute" with 100K NVIDIA H100 chips for fall 2025, 4x larger than Meta’s current supercomputer.

xAI is about a year behind competitors in the LLM space but aims to advance with new algorithms to achieve AGI.

*from our sponsors

Maritime Analytica

Your gateway to the world of container shipping🚢. Join over +11K subscribers in exploring the latest maritime news 📰, sustainability practices 🌱, cutting-edge tech 🌐, financial trends💸, captivating games 🎮, and inspiring maritime arts 🎨. Stay informed, stay ahead. ⚓ Join today for free.

Learning With Data

Unlock expert insights from a hands-on CTO to build happy, high-performing tech teams. Get practical advice every week—start for free today!

Top 3 Charts of the Week

1. 🚗 Toyota Goes All-In on Hybrids

Toyota plans new smaller internal combustion engines by late 2026, signaling gradual EV transition.

Fiscal year end March 2024: 1.1% Toyota sales were battery electric vehicles (BEV), 35%+ hybrids.

US BEV sales flat in Q1 ’24; Toyota bets on hybrids, predicting BEVs cap at 30% market share.

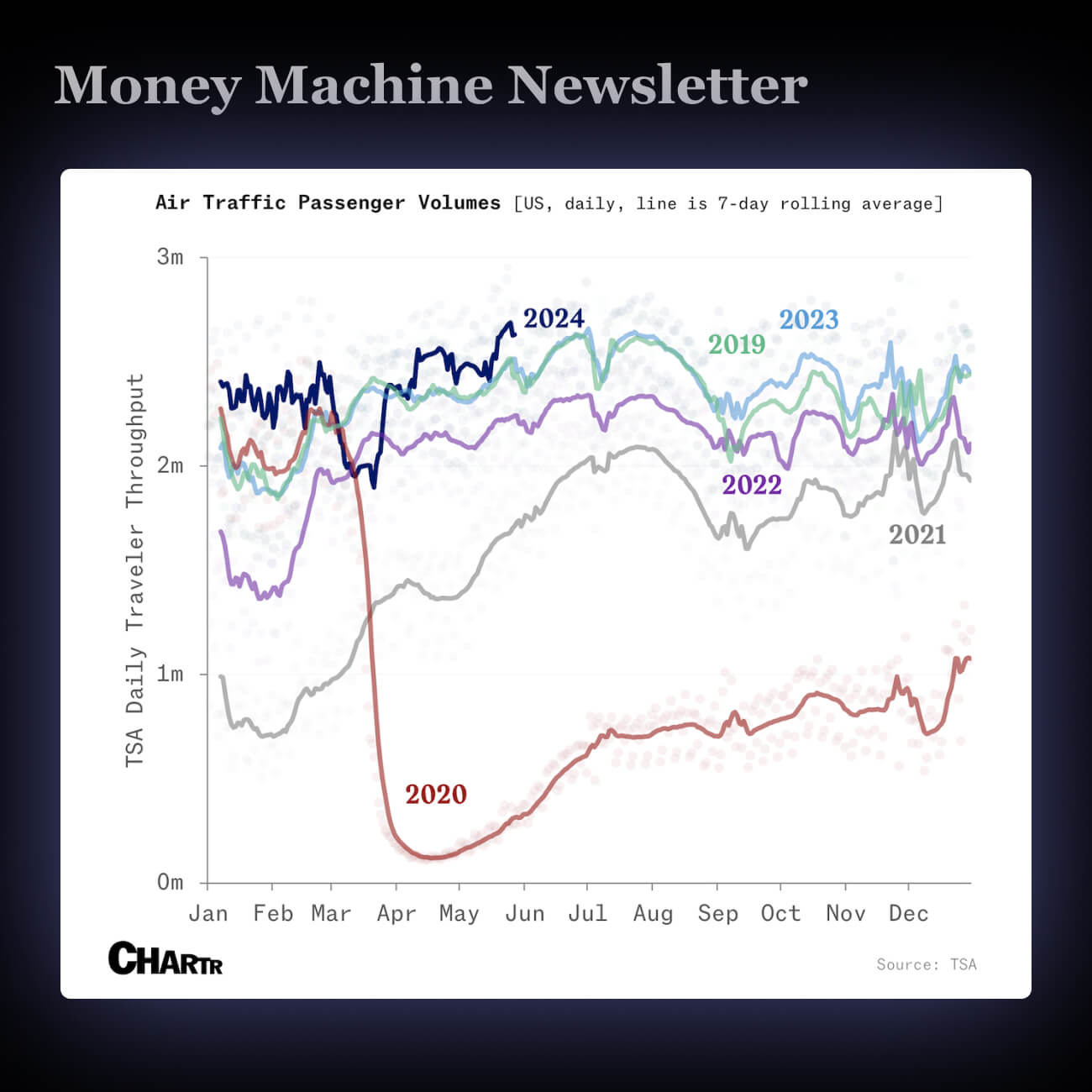

2. ✈️ Air Travel Soars To New Heights

TSA recorded 2.95M travelers in one day, breaking the previous record of 2.9M.

Average daily passenger throughput for 2024 is 2.36M, 47% higher than 2021.

Air travel faces challenges with a shortage of 3,000 air traffic controllers.

3. 🐶 Chewy's Subscription Business Booms

Chewy shares rose 30% this past week due to impressive Q1 results.

Autoship sales, up 6.4% year-on-year, now constitute over 75% of Chewy's business.

Revenue per active customer increased to $562; announced a $500M share buyback.

Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber 🚨

TOP 5 STOCK IDEAS, picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS throughout the week as we spot them.

Access to OUR COMMUNITY of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY of which ideas performed best.

NO GUESSWORK. You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS, discover opportunities and risks not highlighted elsewhere.

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.