This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Apple can’t lead if they’re afraid to break things.

“Made in USA” just hit a HUGE roadblock.

Big tech’s secret chip weapon (not Nvidia).

A $10B dynasty up for grabs.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🫣 Apple Safely Building Into Irrelevance

Everyone says Apple is behind on AI because Siri’s a joke. That’s not the real issue. The real issue? Apple stopped taking risks…

While everyone’s building agents and AI copilots, Apple’s showing off… a liquid glass redesign.

It didn’t start this way. Siri was first. Apple had the lead. Then they got scared. Started hiring for safety instead of boldness. Traded guts for polish. And you can’t polish your way into the future.

The execs? Same folks for 20+ years. The culture? Built to avoid mistakes, not chase breakthroughs. Their best hires? Finance people, not AI builders…

They spent $10B on a car project. Walked away. Biggest acquisition? Beats headphones.

Meanwhile, OpenAI raised $13B and rebuilt the internet’s brain. And AI talent is not going to Apple. They’re going to builders who want to take big swings. And Apple doesn’t swing anymore. That’s how giants fade. Not overnight. Just slowly… safely… into irrelevance… And yet, Apple still holds the winning hand…

~$3T market cap

Billions of devices

Deep consumer trust

They could go big. Buy OpenAI. Build a truly remarkable wearable AI. Launch a humanoid robot. But they’ll need to break things to do it. Because the future doesn’t belong to the careful. It belongs to the gutsy.

2. 🛑 Made in USA? Not So Fast…

Clean energy is booming. But we’re still hooked on Chinese batteries. That’s starting to change… massively… but not without it’s roadblocks…

U.S. energy companies recenlty pledged $100B over 5 years to build battery plants here. That’s on top of the $85B already in motion.

The goal? Supply 100% of U.S. energy storage needs with American-made batteries by 2030.

That’s a factory boom… big names are in…

This isn’t just about batteries… It’s about building a homegrown industry. It’s about cutting reliance on overseas supply chains. And maybe exporting our power back to the world… but it just hit a roadblock…

Trump’s “One Big Beautiful Bill Act” takes direct aim at the incentives behind the $100B battery boom. The 2030 goal of 100% U.S.-made batteries? Suddenly shaky. Now it’s all riding on what happens in D.C. over the next few months.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🤫 Big Tech’s Secret Chip Weapon

Broadcom (AVGO). No flashy launches. No GPU hype. Just custom chips built for the biggest players in tech — Google, Meta, ByteDance. The kind of silicon that doesn’t just power AI... it unlocks it…

But they’re not just making chips. They’re owning the AI plumbing — networking gear, software, virtualization, and more. A full-stack empire.

And they’re not chasing everyone. Just the top of the top. Broadcom’s CEO thinks they’ll grab up to $90B in annual revenue from AI by 2027.

VMware integration gives them a software edge — $21.5B in software revenue (up 181%).

$15B in Q2 revenue (up 20%)

$4.4B from AI chips alone (up 46%)

$6.4B in free cash flow (43% of revenue)

Risks…

30% of revenue tied to China.

Geopolitical tensions, export bans.

AI is the new cloud. Everyone’s rushing to build on top of it. But Broadcom They’re not just playing the game. They’re designing the stadium. Become a premium subscriber and get alerted when this stock triggers our setup for entry point, target price, and stop loss.

Top 3 Charts of the Week

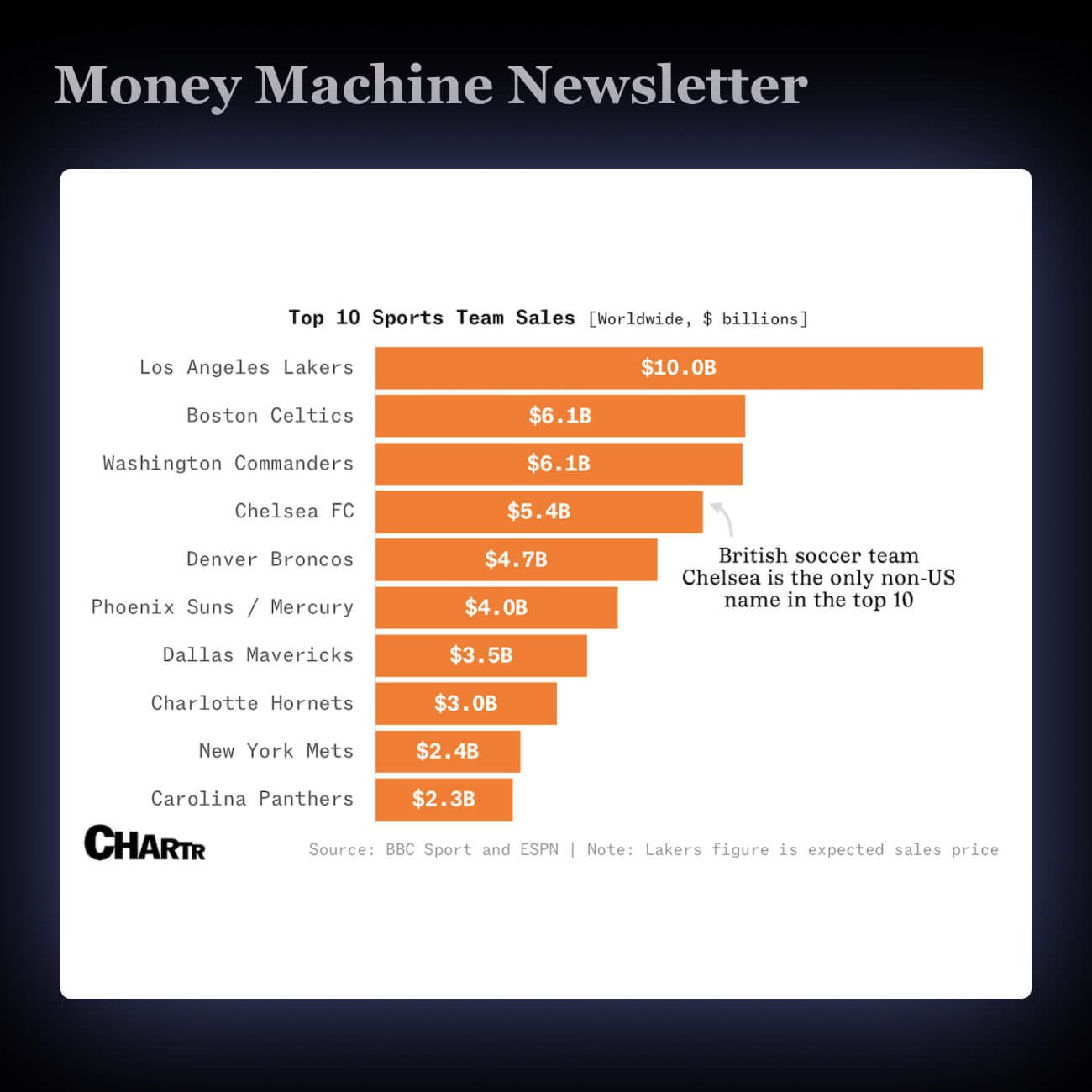

1. 🏀 Biggest Sports Fortunes Start in the U.S.

The Lakers might sell for $10B. That’s a record. And it could end the Buss family’s 45-year run.

NBA team prices are going vertical. A string of $3B+ deals proves it—U.S. franchises are now global trophies.

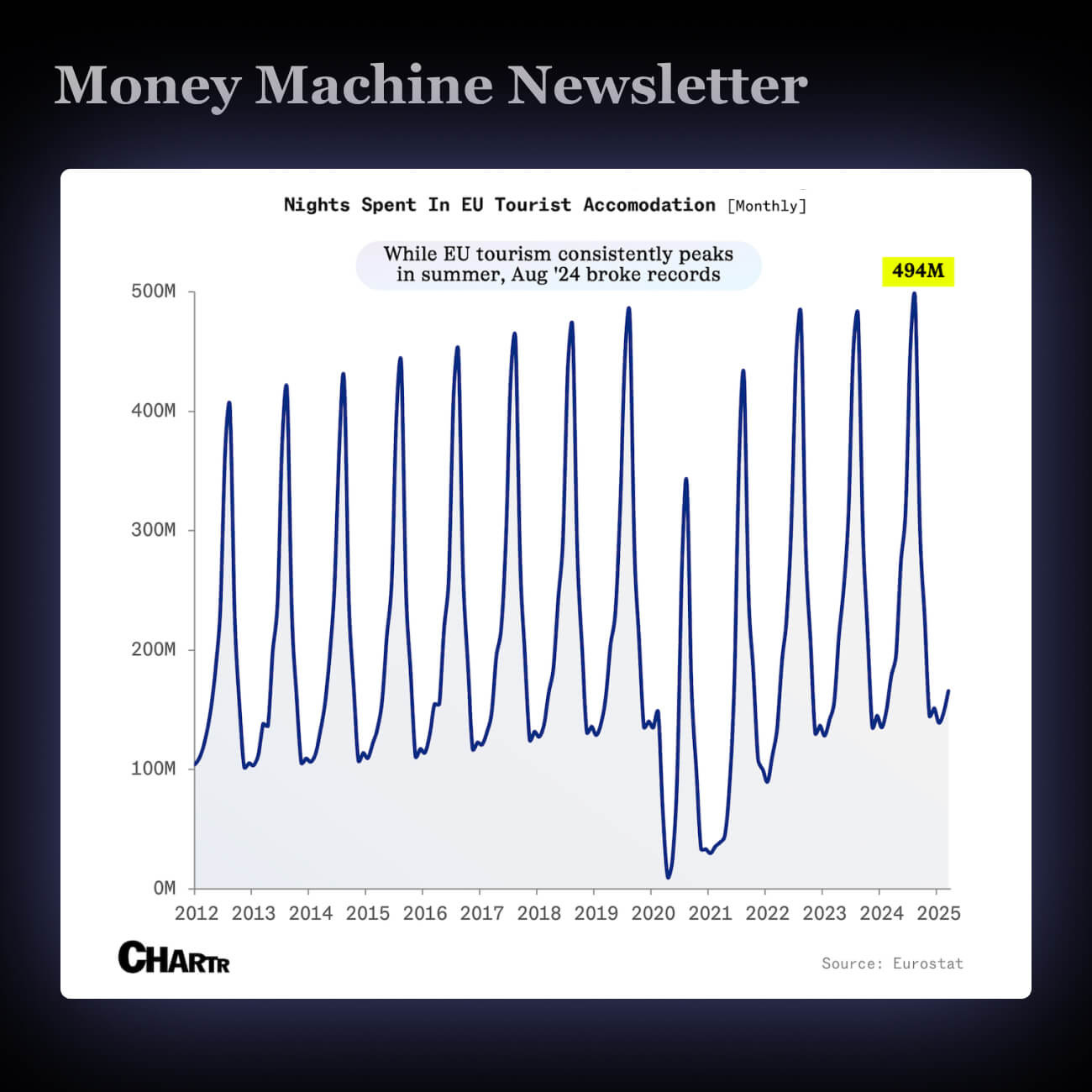

2. ☀️ European Summer Is Only Getting Busier

Locals in Europe are fed up. Protests. Tourist spray-downs. Even Louvre shutdowns. Too many visitors. Not enough space.

Europe had 747M tourists last year. Spain, Italy, and France? Over 1.4B tourism nights. Cities are fighting back with taxes, crowd limits, and Airbnb bans.

The welcome mat’s wearing thin. Travel’s still booming—but expect tighter rules, higher costs, and less patience abroad.

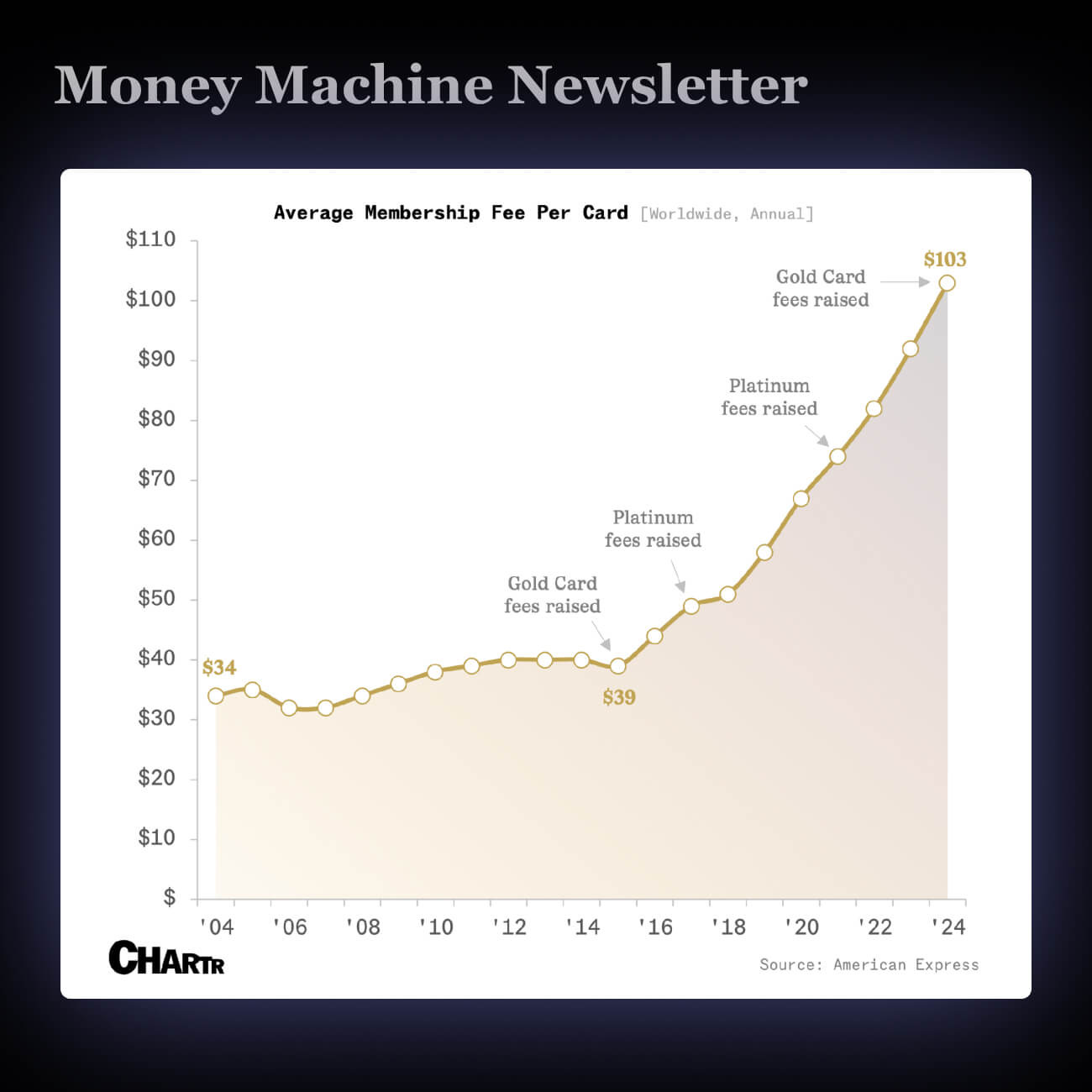

3. 💳 Amex Cards Are Pricier Than Ever

Amex and Chase are jacking up card fees—some as high as $795. In return? More perks. More flash. Amex just did its biggest refresh ever. Chase followed suit.

It’s not just about spending—it’s about status now. These cards are brands. Amex has 147M users and doubled its average fee. Chase wants a slice of that.

If you use these cards, expect flashier rewards—but also higher costs.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.