🤝 Nvidia's $1T Pivot (3 Key Partners...)

Plus: Gut-Brain Health Breakthrough, Is the AI Bubble Reaching a Tipping Point?, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Nvidia relies on THESE 3 key partners for a $1T pivot.

Gut-brain health breakthrough may bring major profits for a few companies.

AI revenue gap grows from $125B to $500B—where's the ROI?

Q3 not looking for good THIS apple product.

And more. Let’s get to it!

Follow us on Instagram | Advertise to our 7K+ subscribers

Top Insights of the Week

1. 🤝 Nvidia's $1T Pivot (3 Key Partners...)

Nvidia's market cap jumped a record breaking $277B in one day, surpassing the total market cap of McDonald's, Coca-Cola, Disney, Shell, and Netflix. Wild!

And they’re not done. They’re shifting to a new AI sector and predict $1T in Big Tech spending within four years. All the heavy hitters are on board as customers—Amazon, Meta, Microsoft, and Google. What is this sector?

Generative AI. This involves creating new content, such as text, images, and videos, through AI models.

Behind the scenes, Nvidia relies on these three companies to make this shift.

Micron Technology provides essential memory and storage.

TSMC manufactures high-performance chips.

Arm Holdings collaborates with Nvidia on AI processors.

Generative AI market: ~$20B in 2024, projected ~$136B by 2030.

2. 💊 Gut-Brain Health Breakthrough

What does the gut have to do with autism? According to this study, everything.

Study shows gut bugs could lead to diagnosing autism spectrum disorder (ASD) more quickly and accurately.

Autism spectrum disorder’s impact…

1 in 36 children in the U.S. are diagnosed with ASD

This breakthrough could offer major profit opportunities for a few companies.

Autism spectrum disorder market: ~$32B in 2023, projected ~$40B by 2030.

3. 🚀 Cara is the world's AI Sales Agent. She runs your B2B outbound sales campaigns on auto-pilot.*

Cara is an AI Sales Agent that generates new clients on autopilot.

Compared to a human AI Sales Agent Cara

Generates 2x more positive replies

Is 5x faster to employ

Is 10x more cost efficient

Enjoy a 5% discount for Money Machine Newsletter readers. Use coupon code "MMN" at checkout (only 10 available).

*Sponsored

4. 🤔 Is the AI Bubble Reaching a Tipping Point?

AI revenue gap has widened from $125B to $500B. But where’s the ROI? At least that’s a question some are asking. Show me the money!

Some of the criticism is solid, at least partially. Here’s the counter argument—tech revolutions often start with short-term bubbles that are later justified.

Internet started with dial-up. Later, telecom companies came in and invested more than $1.6T in broadband, which seemed wasteful after the dot-com crash. We all know how that story ended. Same for 19th-century railroad expansion.

Do we have a capital expenditure problem? Maybe. But we saw this during the dot-com boom. Companies built data centers, but by the time they were profitable, they needed new telecom equipment and servers, resulting in write-offs.

Big tech isn't focused on short-term revenue. Right now, it's about an AI and GPU arms race they can't afford to sit out.

Regardless of what happens in the short term, AI is here to stay.

*Sponsored

Maritime Analytica

Your gateway to the world of container shipping🚢. Join over +11K subscribers in exploring the latest maritime news 📰, sustainability practices 🌱, cutting-edge tech 🌐, financial trends💸, captivating games 🎮, and inspiring maritime arts 🎨. Stay informed, stay ahead. ⚓ Join today for free.

AIModels.fyi

Get a digest of new AI research, how-to guides, and top models. Subscribe for free.

The Tech Bridge

Join over 45,000 readers who use the Tech Bridge to understand a simplified approach to the world of technology. Stay ahead with clear insights and practical strategies curated for aspiring entrepreneurs, founders and product builders. Join today for free.

Top 3 Charts of the Week

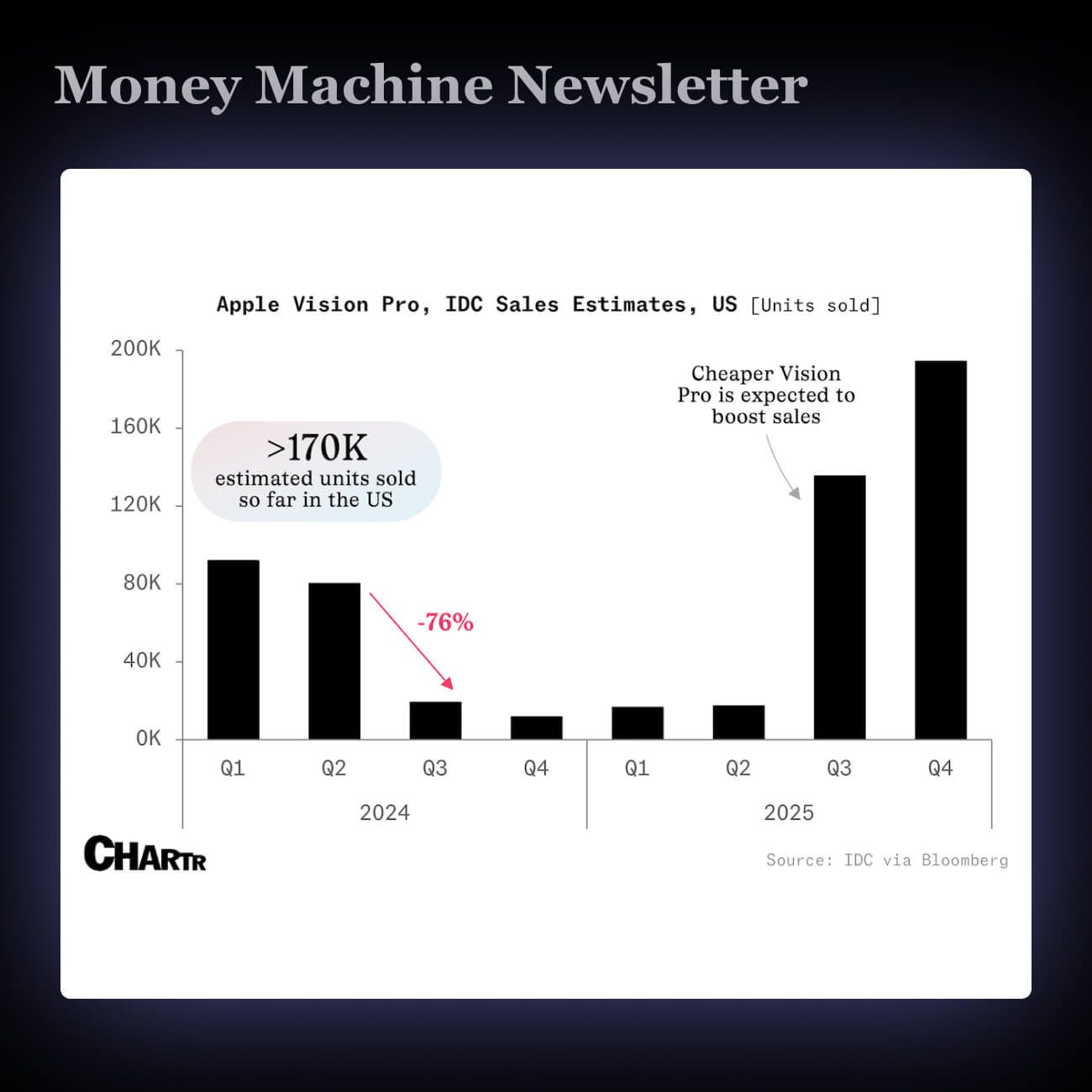

1. 😬 IDC Predicts Vision Pro Sales to Plunge This Quarter

Apple’s Vision Pro has sold fewer than 172,000 units in the U.S.

Q3 sales may drop 76% due to a $3,500 price and limited app offerings.

Future sales depend on international releases and a cheaper model next year.

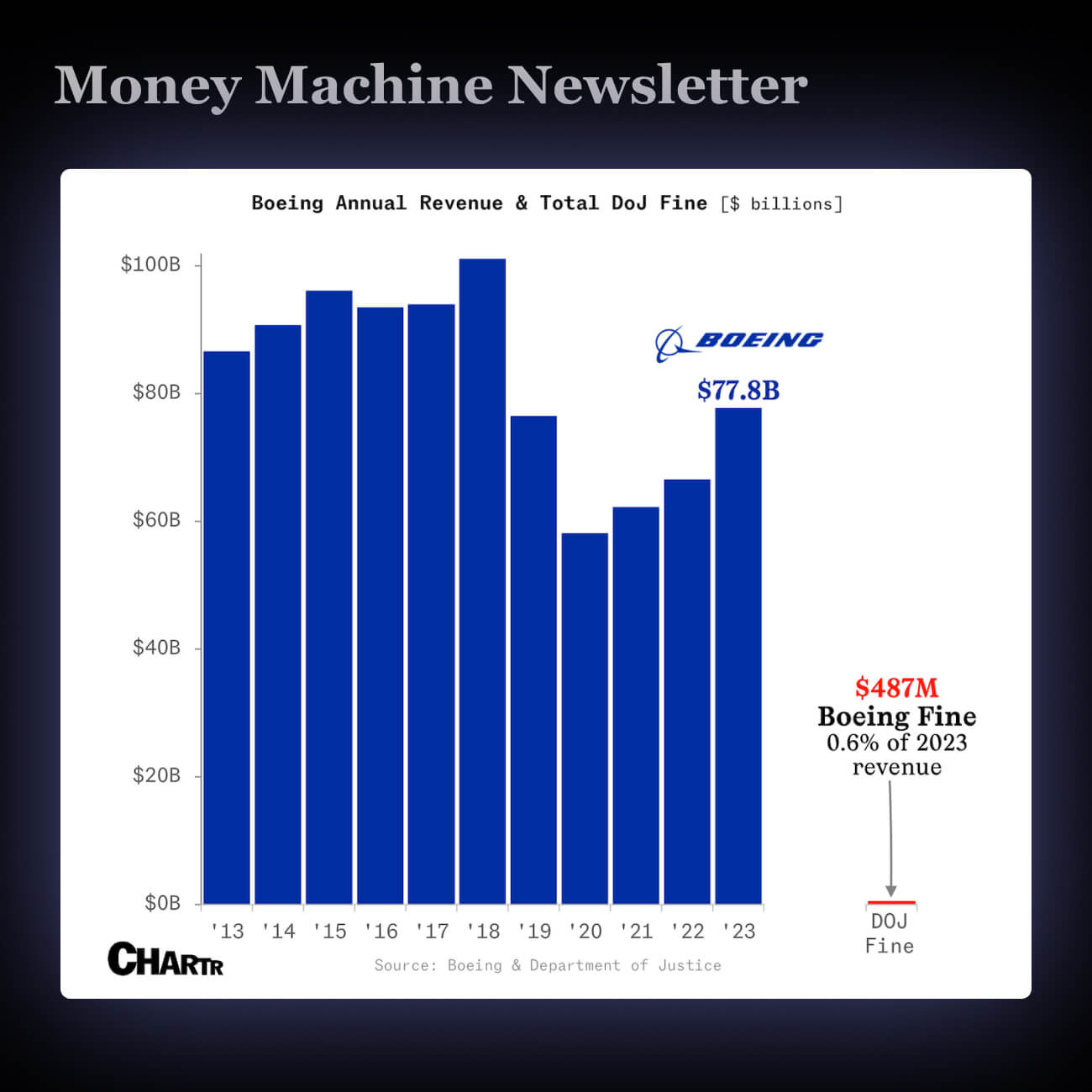

2. ✈️ Boeing's Fine Is 0.6% Of Its Revenue

Boeing will plead guilty to misleading air safety regulators before the fatal 737 MAX crashes, with a $243.6M fine and $455M safety investment.

The plea risks Boeing's $22.8B military contracts and doesn't address recent safety issues.

The fine is a mere 0.6% of Boeing's annual sales, far less than the $25B victims' families sought.

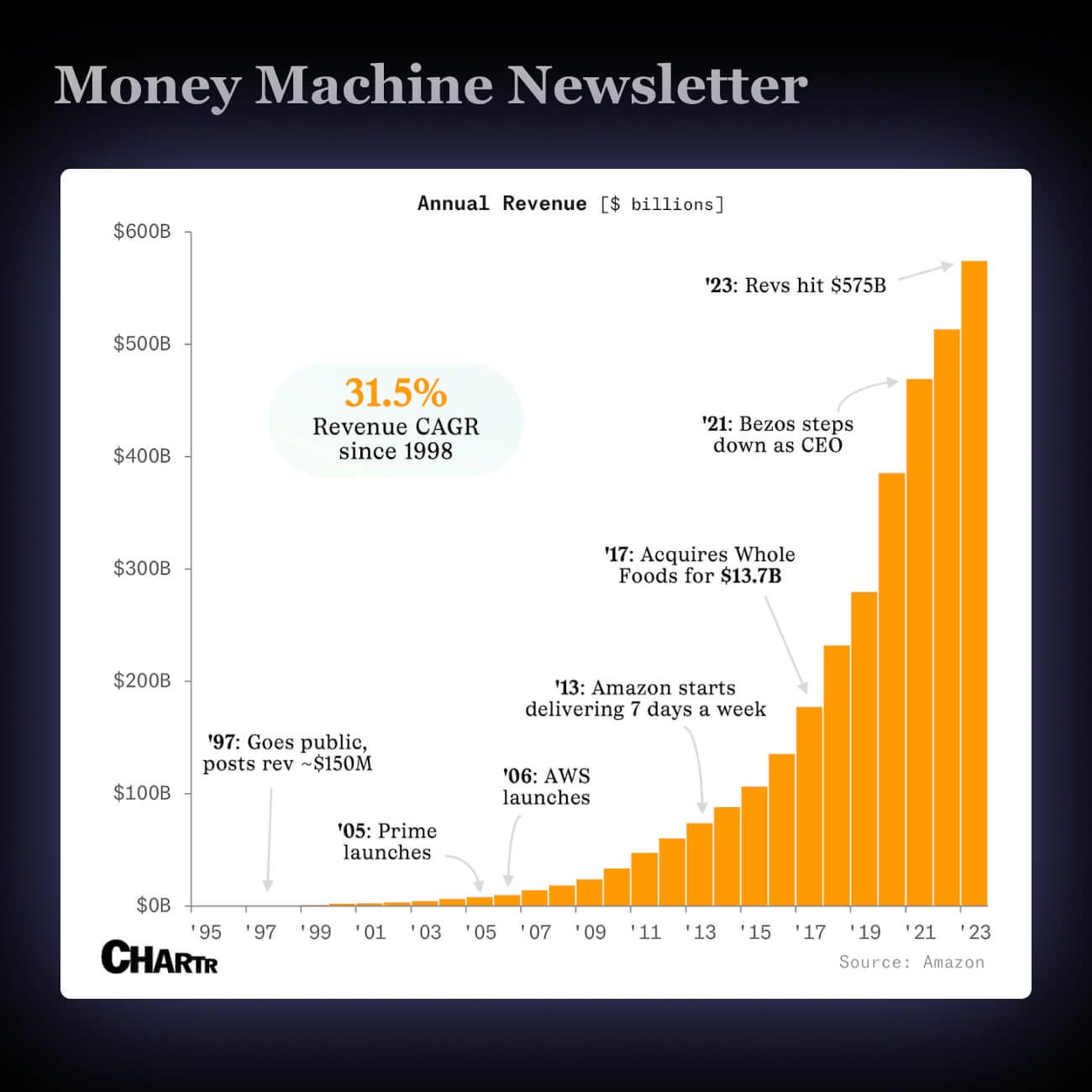

3. 💰 Amazon Still Dominating at 30

Amazon turned 30, with a $2T valuation and 31.5% annual growth.

Prime and AWS drove Amazon’s dominance, but unionization and Temu competition loom.

Amazon's evolution shows market shifts and the impact of emerging rivals.

Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber 🚨

TOP 5 STOCK IDEAS, picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS throughout the week as we spot them.

Access to OUR COMMUNITY of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY of which ideas performed best.

NO GUESSWORK. You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS, discover opportunities and risks not highlighted elsewhere.

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.